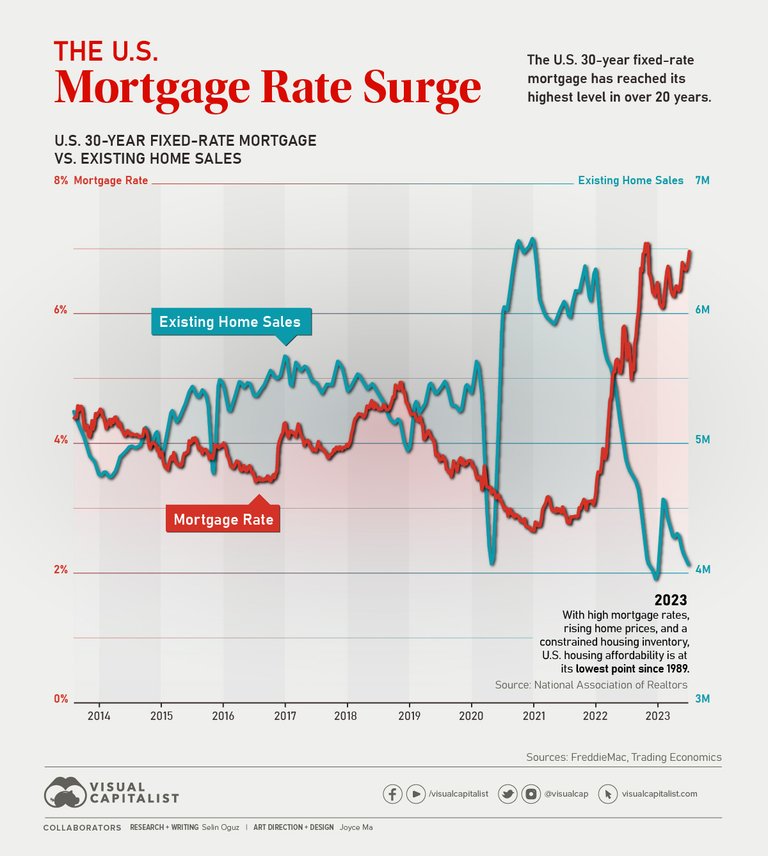

US fixed mortgage rate hits highest point in 20 years

5 % difference in 18 months

This week the 30 year US fixed mortgage rate hit 8 %. Which is the highest rate in 20 years. The difference with March 2022 is immense, back then the rate was 3 %. A difference of a whopping 5 % in 18 months. The tempo of this rise has never been seen before.

But surprisingly it hasn’t brought down housing prices yet, to the contrary, houses are 4 % higher than 1 year ago. This means that demand is still higher than supply. And also means that mortgage payments are a lot more expensive than 18 months ago. In some cases more than a 1000 USD in interests are paid per month.

Economics still too strong

Federal Reserve officials are advocating to leave the Federal funds rate unchanged between 5 and 5.25 % for a longer period because of strong economical reports, which indicate inflation is remaining high, so interest rates are not inclined to drop anytime soon.

It shows that inflation isn’t something that is so easy to influence with interest rate policies. Employment and fiscal policy are also important parameters that have an influence on inflation.

Let’s hope for young buyers that rates drop soon…

Sincerely,

Pele23

I think 2024 will be the year of interest rates.

Here in our country, the prices of all things have gone up, what used to cost a dollar is now about four dollars, but property prices have gone down because people don't have money to buy.

Yay! 🤗

Your content has been boosted with Ecency Points, by @pele23.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more