Lesson 3: Bitcoin is not ready for mass adoption: scalability problem

Hello friends. I've been posting a few lesssons of thing I've been learning related to blockchain technology. This time I want to talk about bitcoin scalability.

Have you ever dreamt that you could buy in store with BTC or buy something online with your earned crypto? It's possible, but still ver limited.

The main idea in this lesson is that Bitcoin, they way it is right now, is not ready for mass adoption.

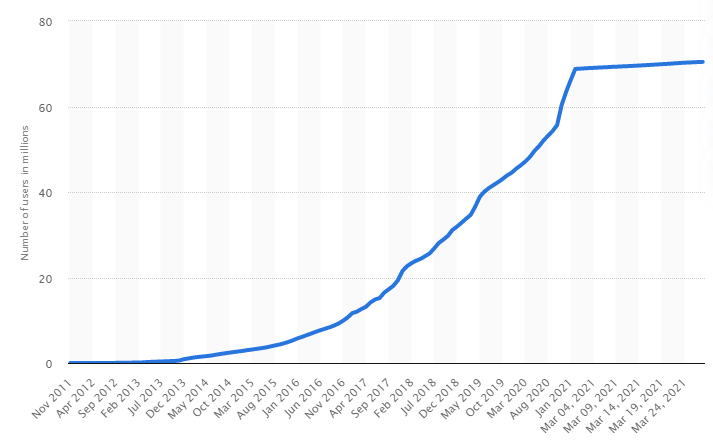

I know it sound weird since the following chart indicates that there are 80 million of unique BTC wallets and the number has been rising every year.

source: https://www.statista.com/statistics/647374/worldwide-blockchain-wallet-users/

Do you remember when I told you that 1 block in BTC blockchain storages 1MB of info in every block?

Block structure is exactly the reason why scalability of BTC is a problem. For example VISA, can process something like 1,700 transactions per second, around 1M per 10 minutes. Bitcoin can do 4200 every 10 min.

That simple, BTC can't substitute mainstream payment.

I imagine you're yelling me: just increase the block size!!!

Well, if you increase block size, it would take huge space to storage one copy of blockchain and that would cause end of decentralization Who can storage all that amount of information? Big companies. Who would own 51% of mining power? Big companies

Temporary solutions: Segwit and forks

According to Investopedia, SegWit is the process by which the block size limit on a blockchain is increased by removing signature data from bitcoin transactions. When certain parts of a transaction are removed, this frees up space or capacity to add more transactions to the chain.

Hardware wallets like Ledger and TREZOR support Segwit, also digital wallets like Coinomi and Coinbase support it as well. SegWit is yet to be fully adopted. Currently, the percentage of Bitcoin addresses using SegWit is around 53%. (hint: BTC wallets start with 1, while Segwit start with 3 or bc1, check it out)

Another solution to BTC problems is hard forks. This way you change BTC source code and create a new coin that's not compatible with the original blockchain. Examples are Bitcoin Cash(increased block size to 8MB), Bitcoin Gold and BitcoinSV.

I'm very happy of being able to answer one of my many question concerning BTC and hope this can be useful for all. Soon I'll be moving to smart contracts and DEFI, but I felt like I needed these lesson to understand what's coming.

Previous Lessons

https://leofinance.io/@mejiasclaudia/understanding-blockchain-from-scratch-lesson-1-what-s-happening-underneath

References

https://decrypt.co/47913/bitcoin-is-not-yet-technically-compatible-with-mass-adoption

https://academy.bit2me.com/en/what-is-bitcoin-scalability/

https://www.buybitcoinworldwide.com/segwit/

https://en.wikipedia.org/wiki/List_of_bitcoin_forks

Posted Using LeoFinance Beta

I think you mean 80 million right?

Right now, it seems that BTC at its core level and what most seem to be stating it now is a store of value i.e. buy it, hold it for a few years and it will appreciate in price (not financial advice). So BTC right now appears to be mainly to move large sums of money (if you price it in fiat) but one question I have is if it's just considered purely in sats, are those network fees the same amount?

However, there's 2nd layer solutions that are being used as a way to send as little as single satoshis out quickly and with lightning network in development, there's another layer which is looking to use Bitcoin as a currency to spend. @chekohler has been digging deep in to this so will be able to shed more light on that.

I'd say that BTC is a lot more accessible now than it was just 5 years ago but looking at Visa and PayPal now accepting payments, I don't think we're as far away from a version of mass adoption as some may think...

Yes!! I totally agree. Corrected the 80 billions (way too much)

Definitely BTC is going to be mass adopted as store of value, it is already, because without having many applications as other blockchains, it is the leader in capitalization, and the scarcity associated with the mining will increase that value.

I meant, not scalable as itself and as transaction currency to descentralize mainstream channels. Indeed I was reading information about Ripple approach to make descentralization possible for international bank transactions. And yes, Lightning network is a topic I'm working on as well.

Thank you for commenting.

Posted Using LeoFinance Beta

I think a lot of the scaling critique is also around poor UTXO management a lot of people don't interact with the chain correctly and group too many UTXOs together and thus increasing their transaction size even if the value isn't high in terms of Satoshis and then say Bitcoin isn't scalable

Sure this isn't a front end thing most people see or understand abs they pay the price for it but I don't think that's the fault of the chain either, but user experience interfaces and education on Bitcoin

If only a couple of fine young gentlemen could get some free time and create a manual of some description 😛

Lol If Bitcoin were to moon and buy these gentlemen lets say a 1 month paid vacation I think it could be done

I think the idea of on chain scaling will always leave you with the same problems it’s never going to scale on chain and there’s no technology around that’s proved differently! These shit coin pitches are just pure marketing and don’t say what they give up for improved transactions

The scalability trifecta has not been solved if you want scale you have to either sacrifice decentralisation or security two of which Bitcoin will NEVER do! Security and decentralisation is far more important to Bitcoin than scalability on chain

I think that all successful monetary networks over a human lifetime has been layered money! So going with a layered solution is the better option it allows technology to compete to solve it we currently have liquid and lightning at the moment, RGB, DLC and OMNI as well as counterparty are also trying to bring solutions for side chain scaling and new features

The main chain to me is only their to maintain the integrity of the bearer asset! Layer 2,3 and even 4 will come with time