Staking and managing your different tokens

Last week I posted a blog explaining how you could earn some extra coins by using the right tags for your posts; Earn tokens by using tags

You are probably collecting all sorts of coins in your wallet on https://hive-engine.com/

But then what?

Are you going to wait until one of them skyrockets or are you going to convert them in the coins you believe in?

I used to do the latter; I’ve converted a lot of small amounts into Hive and Leo in the past. But I have a different tactic now;

I’m staking most of them.

What is staking

You receive most coins you earn in a liquid form. This means you can send them to withdraw, convert or send them to someone else.

But there is another thing you can do which is staking. When you stake a token you actually lock on the blockchain.

By locking the tokens you are empowering your stake of that specific coin. This means that you will get curation rewards when you vote on posts with that token.

You will automatically vote with every staked coin on a post from every interface you vote with.

For instance; If someone creates a blog on Leofinance which is about crypto technology they could add the tags “LEOFINANCE”, “STEM” and “ASH”. When you vote on that post you will get curation rewards for your staked Hive, staked Leo, staked STEM and staked Archon tokens. How cool is that!

Archon drips

Staking the Archon token has even more advantages. By staking the token you’re increasing your Governance Power (GP).

Each day a small percentage of @archon-drips will be distributed to Archon stakeholders.

You’ll be getting even more free tokens.

Token overview

You can see which tokens you have in the Hive engine (https://hive-engine.com/).

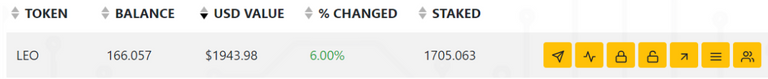

Here’s a screenshot of mine:

The first numeric column is the amount of liquid tokens. As you can see I almost haven’t got any liquid tokens (actually I do, but I will get to that later). You can also see the value of the token isn’t shown because most of it is staked. The amount of staked tokens is in the column next to the percentage.

You can simply stake the tokens by clicking the padlock icon. And you can unstake by clicking the unlock icon.

Unstaking

There is one very important thing you need to know about unstaking. Unstaking often takes a lot of time! The amount of time depends on the token. Leo is quite quick with ‘just’ four weeks, but some tokens may take upto 12 weeks to unstake. Your tokens will gradually be turned into liquid again. So if you need your tokens quickly you shouldn’t stake them.

Hive and Leo

And this is why I don’t stake all of my tokens. I want to have some liquid tokens to move around. I’ve chosen to keep an amount of Hive and Leo in a liquid form. Every 1st of the month I join the Hive and Leo Power Up initiatives to stake a part of my liquid Hive and Leo, but also save some in my wallet.

Leodex

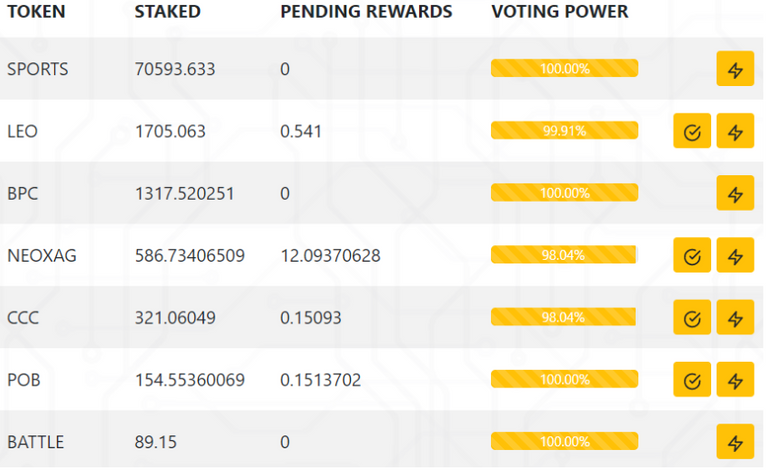

You can manage your tokens with the Hive Engine wallet, but I prefer Leodex. You can access Leodex via https://leodex.io/

The Leodex interface can give you a lot of information about your tokens.

When you go to “Wallet” you can manage your tokens.

The icons from left to right mean the following: Send tokens, Market Price, Stake, Unstake, Delegate, Past transactions and the rich list.

Under “rewards” you can see your staked tokens, the tokens you can claim and the actual voting power.

You can claim your unclaimed tokens with the claim button. Tokens can be claimed once a day.

The lightning bolt icon gives you access to the vote multiplier. You can use the vote multiplier to adjust your votes for the different tokens.

This is useful when you’re using a tokens own interface to vote on posts.

An example:

I’m using the Leofinance interface for my financial posts and I also do curating on there. Normally when you cast a 100% vote on Leofinance you send a 100% vote with all the tokens you own.

Since I don’t want my other tokens to be given away when I vote on Leofinance posts I have set a multiplier.

It works as follows:

I’ve configured a 10x multiplier for Leo. This means that all my votes via the Leofinance interface get multiplied by 10.

But only the Leo votes, not all the other tokens. This means that when I cast a 10% vote on Leofinance, it will be multiplied in a 100% Leo vote, but will only cast a 10% vote of the other tokens.

This way you can spend your tokens on your preferred interfaces and get the most out of them.

FriendlyMoose

I'm crypto and security enthousiast with a passion for photography that likes to play games.

Follow me on noise.cash: FriendlyMoose

My photos on Wax: wax.atomichub.io

Consider voting vor Leofinance as a Witness!

Posted Using LeoFinance Beta

View or trade

BEER.Hey @friendlymoose, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.This is simple and easy explanation for beginners

Posted Using LeoFinance Beta

Very well written and with perfect photos gonna share it in helpful tool sites

Thanks , what will be the next tutorial exchanges and how to convert to hive ?

Thanks! And also for sharing!

I don't have a lot of experience with exchanges, but I do have some other ideas.

I stake almost all my tokens except now I sell off BLOG whenever I get it. I've already written a post about why.

I knew about Hive Power UP but I didn't know Leo had a similar initiative.

an easy guide for beginners that will help them maximize their earnings

Posted Using LeoFinance Beta

Fantastic article! Great job.

Very interesting! Great post by the way. I was never really sure how Archon worked. I know that I have some of them, but I had a small handful that was sitting there and wasn't staked. I took care of that right away. Most of the other ones I stake in batches when I like the numbers that I have. I like keeping things in multiples of five and ten!

Posted Using LeoFinance Beta

Bookmarking this as I'll have to read it again and implement when I have a bit more time.. thanks for the explanation!