$1 isn't really $1 anymore ?!?

The value of a dollar has changed over time, whether it was last year, the year before, or a few decades ago. Since the 1980s, when the rate of money printing and inflation has skyrocketed, the value of the dollar and other money has been eroded by the teeth of time.

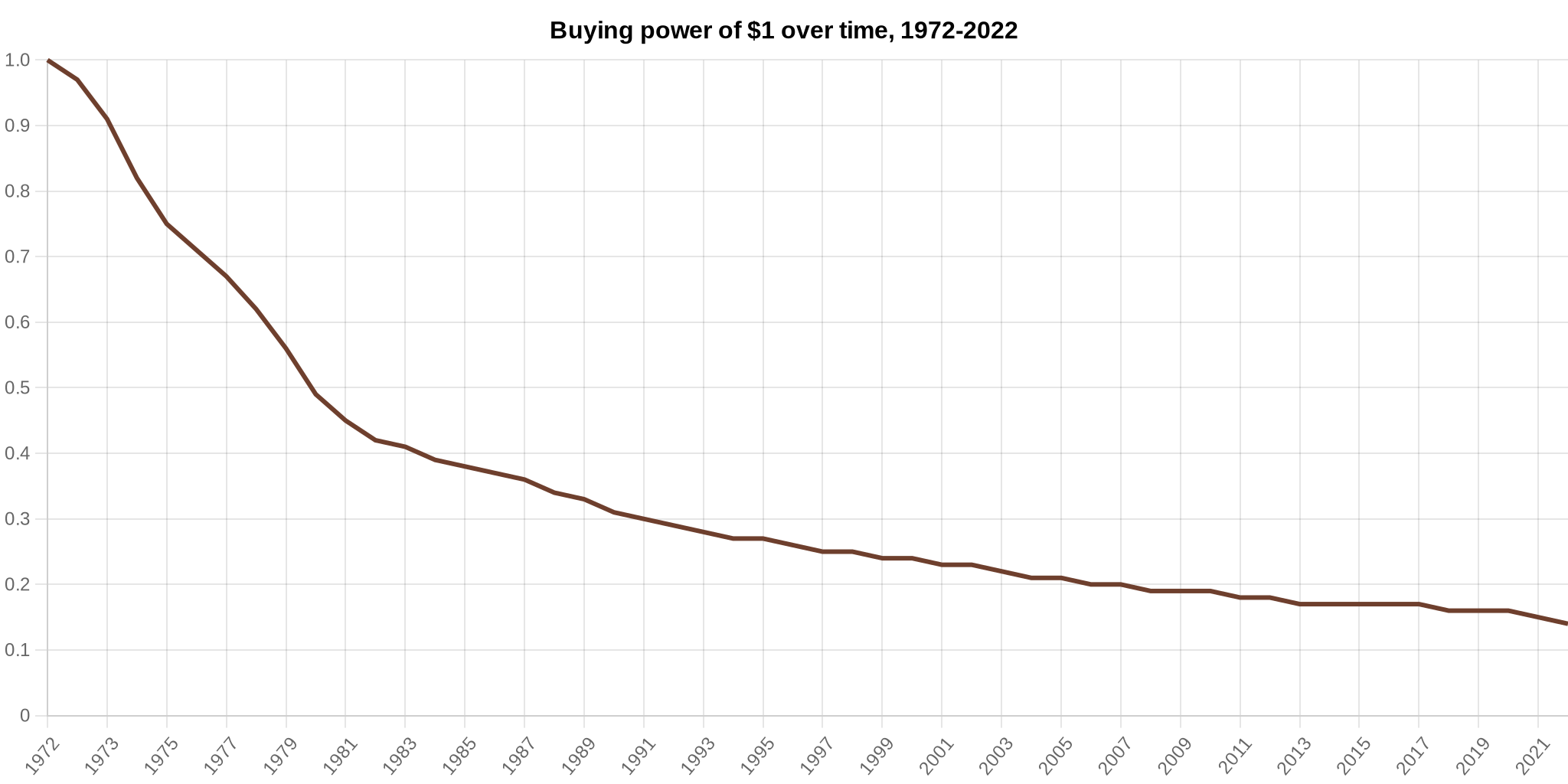

You can see here how much money can lose in value over a period of time. In the last 50 years, the dollar's "real value" has fallen, raising concerns about the dollar's long-term viability. Data shows that the US dollar has depreciated six times in the last 50 years. The real value of $1 was $1 in 1972, but today it is only worth $0.14. This information comes from the US Department of Labor and was calculated by researchers at Officialdata.org

As a result of devaluation, the equivalent of a dollar in 1972 is now $7.09. When a dollar becomes worth $7.09 over time, its "real value" decreases. This means that you can buy fewer things with a dollar. The current inflation rate is 9.1%, the highest since 1981 when it was 10.32%. In 1980, 13.50% was the highest rate ever recorded.

Even when the economy has recovered from severe crises like the 2008 recession or the ongoing Covid-19 pandemic, inflation in the United States has always risen.

During the pandemic, the government continued printing money and major central banks pumped $9 trillion into the economy, resulting in the depreciation of the US dollar. The purchasing power of the dollar is depreciated when inflation is high. In most cases, the government prints more money to compensate for the shortfall.

The Federal Reserve (Fed) has also played a significant role in the dollar's devaluation. As a result of Congress passing stimulus packages to help people and businesses stay afloat, more money has been generated while interest rates have remained high. Meanwhile, imbalances in the US budget have reached dangerous levels, contributing to rising inflation. In the past, huge deficits have been associated with rising inflation.

Fuel prices, food prices, new car prices, mortgage rates and so on are all on the rise. It's also possible that inflation won't return to pre-pandemic levels for a minimum of three years or more.

It is likely that the dollar's value will continue to fall, thus eroding its status as a safe haven currency.

Investors are now considering investing in gold since gold has traditionally been a safe haven during economic downturns. In the event that the currency falls faster than expected, gold investors could profit - in turn, that would lead to hyperinflation. Analysts however, believe that gold will remain in the current range for some time to come.

Last but not least, the emergence of cryptocurrencies like Bitcoin has received serious support at times from institutional investors. The depreciation of the dollar is seen as one of the main reasons why many investors are turning to Bitcoin, which they often refer to as "digital gold", because of the limited supply.

All in all, investors are being cautious; the Fed raised interest rates not long ago to cope with rising prices and might do it again in a few days, which may lead to amplifying the shift away from crypto instruments in favor of a move closer to traditional markets and currency.

Another shout-out to @bradleyarrow Thank you for your continuous support!

Join ListNerds, send mails promoting your Hive posts, read mails, upvote mails and earn crypto in the form of CTP tokens, LISTNERDS tokens, and Hive (upvoting on your Hive post by the visitors from Listnerds)!

I tried my best to again use the LeoGlossary, I hope I haven't overdone it.

Posted Using LeoFinance Beta

Actually, the dollar's doing pretty good in recent weeks. We're in UK right now and bounce in and out of EU regularly, last we were here was early 2020. At that time, $1 was £0.75 (25% decrease from the pound) and €0.83 (17% decrease from the euro). Today, $1 is 'practically' 1:1 with the euro and rather than 25% of the pound, it's now 17%.

My preferred version is to say that the euro is doing badly against the dollar, but I do understand the numbers you showed me. What you said works for the past few weeks but if you look at the dollar this year or the past few years it doesn't really look too great.

Thank you so much for stopping by and for your reply!

Yes, the Dollar and all fiat currencies are going to zero: HEX, PULSE, PULSEX, LIQUIDLOANS, HEDRON, ICOSA and LasseCash.

Agree with you, but how many years it'll take for that to happen? I hope not too many!

Thanks for stopping by!

Its hard to say how long it will take, people still need the fiat money systems for housing and stuff, but over time those systems will become weaker and weaker, in the meanwhile us invested in the right cryptocurrencies will own everything of real value.

Posted using LasseCash

By the way please consider posting to LasseCash by just adding the tag lassecash to your posts.

Posted using LasseCash

That could backfire on me:

Dude its literally one whale that dont know that the earth is flat, and therefore downvoted my content on hive for like 9 months now.

He keep claiming it was more people behind it, there was a fw in the beginning of this fight, but they where all smaller guys and I believe they did it to please him: "Do what I say or I will not upvote you, kind-of thing".

If you like my content you can always find it on www.lassecash.com/@lasseehlers

I am even doing more for hive than most average users with my OUTPOST, but still they whales just dont care.

The printing machines will be printing to keep up with printing ;)

"printing machines that are printing other printing machines" - this thought is so close to reality! :)

We're almost there :p

What printing machine?

Posted Using LeoFinance Beta

The money printing machines. Banks can hardly keep up with our debt rate.

The commercial banks are the ones who create the USD.

So how can they not keep up with it since they create it?

Posted Using LeoFinance Beta

Because if the fed (the bigger central banks) stop/decrease money-printing, it could lead to panic since 44% of the GDP is tied to government spending.

Sorry, I didn't mean debt rate, but... it kinda depends on how you look at it. I'm not a financial professional, so please correct me if I'm wrong, but this is what I understood from it;

(I had to look it up again)

The current GDP of the US consists of 44% in government spending. While the Fed prints money to pay for government spending, any decrease in printing money would mean a decrease in GDP. From my understanding, this means that it is required to keep money printed 24/7 (hence the "The printing machines will be printing to keep up with printing") to prevent the public from panicking like crazy :D (since the moment that I learned about this, I already panicked, but this was maybe 6 years ago).

If the government decides to pay off debt, it will increase inflation. So, in a scenario where we print money, which adds to the debt, it seems to almost be impossible to pay off debt, unless we choose to have a higher inflation rate. But, inflation-wise, this is already the case right now (9.1%), even though we're not paying off our debt.

While numbers might not be accurate, if the whole gist of it is incorrect, just let me know (I'm a Dutch guy).

thanks for the update, i have no idea whats happening in the fiat world

In what world are you living then, I want IN !

im 24/7 on chain! i get my wages and convert straight away to USDT.

Man, I remember when a buck was big time for a kid like me growing up in the ghetto.

I could go to the bodega in the corner and with a dollar go get a back of chips, a soda and some candy and still get change back to go back for another haul.

@drlobes

!CTP

Today for a buck, you could still get a bag of chips, or a soda, or some candy, just not all of them together. 🤣

And what was the labor rate back then? How many dollars per hour were people making?

Posted Using LeoFinance Beta

Whew, I’m talking back in the very early 70’s so expectations of not declining would never be a reasonable thought.

At that time, I only knew or was related to folks busting their humps in bodegas, factories, gas stations and supermarkets for the most part.

I think the dollar is holding on OK, considering the US just prints money that does not exist to solve their problems, their only hope it to get a leader that knows how economics works.

@drlobes thanks for sharing on Listnerds 😎

!ALIVE

!BBH

!CTP

!PIZZA

!MEME

Credit: hamzayousaf

Earn Crypto for your Memes @ hiveme.me!

@drlobes! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @benthomaswwd. (3/20)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

The dollar is holding ok for the past few weeks but if you look at the dollar not in the past weeks but years, that's where you see the decline. Thanks for all the tips man!

Yeah i hear ya @drlobes will be interesting to see what happens being in the UK the pound is pretty good at holding it's own for the most part against other currencies 😎

!ALIVE

!BBH

!LOL

@drlobes! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @benthomaswwd. (17/20)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

lolztoken.com

He was a Roofster.

Credit: reddit

@drlobes, I sent you an $LOLZ on behalf of @benthomaswwd

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(3/4)

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

PIZZA Holders sent $PIZZA tips in this post's comments:

@benthomaswwd(1/5) tipped @drlobes (x1)

Learn more at https://hive.pizza.

Just out of curiosity:

How much as the dollar declined in the last 50 years against smartphones, laptops, flat screen televisions?

How about against microscopic surgery? EVs? Batteries? What about solar panels? Wind farms?

How about stock trades? Music? Videos? Long distance communication? Information storage and sharing?

There are countless products and services that are a lot cheaper today than we had 50 years ago yet few talk about that.

And then what is comparable to 50 years ago? Does anyone really equate a car in 2022 to one from 1970?

Posted Using LeoFinance Beta

My subject was to compare the value of the dollar against its own value in the past years, I have no much use for the results that I would get from comparing the dollar from 50 years ago to a product that didn't even exist at that time.

The fact that we have so many gadgets and services at affordable prices today is not thanks to the Fed. The development of technology allowed for more and better goods and services to be produced more efficiently. Also having these products developed and produced in countries where the labor costs are significantly lower helps a lot with cheaper end prices.

Imagine if every smartphone or flat screen were developed and only produced in the US, what would the price of the end product be?

I could talk about that but in another article where the subject would be the advancement of technology and the benefits it brings to so many sectors. It's not the inflation of the dollar that helped in any way for us to have cheaper prices on products and services.

Posted Using LeoFinance Beta

People under estimated the inflation over all the years and especially nowadays. Yes, they see that everything got more expensive but they can't really understand it is the inflation and devalue of the currency. Someone asked on another site what the world most stable currency is and the vast majorly of answers was the US Dollar. People still think the Dollar is strong and some people even believe it's still backed by gold.

Came from ListNerds and voted there!

Someone believing that might get hurt in the near future. And talking about "most stable currency", the dollar doesn't even fit in the top 5 with the Swiss Franc, Japanese Yen, and the currencies from the nordic European countries being in front.

Thanks for you reply and vote!

There will come a time when more people see that unlimited amounts or a limited 21 million is where the true value is found. !CTP

I wish that this would happen at a faster pace as I'm growing older by the day 😁

If it keeps losing value I wonder how it will effect Cryptos?

This has been a big question on my mind.

I tend to think if it lost all value Cryptos would be worth more and would be pegged to gold instead. Maybe I'm dreaming, I don't understand economics well enough to have a strong opinion.

Thanks for the great post.

!CTP

Ideally would be that in the future be able to use crypto to pay for goods or services directly without interference from fiat currencies like the $ but there's still a long way until we get there.

Thank you for your reply!

Yay! 🤗

Your content has been boosted with Ecency Points, by @drlobes.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more