Knowing Decentralized Finance (DeFi) right away

Hello. There seems to be a lot to talk about when it comes to DeFi. I've been dealing with a lot of bold content. We talked about the overview of DeFi, DEX platform using AMM, and lending platform. It seems like we've talked about the most popular themes recently tied to the single word'DeFi'. In order to deal with deeper and more detailed details than this, I think I will have to study a lot, and it seems that it is not something that can be grouped into a universal series called'Common Sense', so I will have to organize a new series.

We've already talked a lot about it, but there's still the last theme tied to DeFi. In fact, I am afraid of the growth of this sector, and at the same time, there are great expectations. What comes to mind when you think of mortgage loans in the financial world? The main player in mortgage loans is probably the house. It's a mortgage loan... I'm reminded of the American mortgage system. When I think of the US mortgage system, I also think of a subprime mortgage. You may know that the protagonist of the subprime mortgage was Collateralized Debt Obligation (CDO), the crystallization of derivatives arising from human greed. Such'derivatives' are investment products that are indispensable when a collateral loan is created. There is no law that decentralized finance will also have no'derivatives'.

What is a derivative product?

There are many types of derivatives, but the basic roots are generally the same. 'We create new investment products based on the value of spot assets.' The most representative example would be the commodity futures trading market. Buying and selling the right to buy certain raw materials (gold/petroleum/natural gas, etc.) on a specific date (expiration date) at a stated price, that is, futures trading. Originally, the futures market was a means of hedge against fluctuations in the value of end-users or real suppliers, but the meaning of the futures market seems to have faded somewhat recently. It is widely recognized by the general public as a kind of speculative market (so-called major league), and in fact, investors who have nothing to do with supply/demand are often used as a means to make a profit by betting on the direction of value fluctuations.

Perhaps because of reflecting this speculative demand, the Bitcoin exchange that broke all prejudices created a futures trading market with no maturity date. In fact, a futures market with no expiration date is a very awkward concept. They buy and sell certain assets with each other, but there is no actual date for a contract to be concluded. what is this sound! I'd love to, but it's already happening in the financial world. In fact, even if the futures transaction of commodities bought and sold in the financial sector is due, it is common that the contract is simply liquidated at the price on that day. In that way, the maturity date can feel like a useless burden for a particular investor. In particular, from a speculative point of view, it is a big advantage that no expiration date for entering users (there is no cost like roll-over).

For those who enter the futures market from a speculative perspective, the futures market is a'free leverage' heaven. You can buy and sell commodities up to 5 to 20 times the value of your collateral. Futures investors may be smarter than those who take credit or stock-backed loans and buy the same product (e.g. NASDAQ). Of course, some people get full leverage in the futures market by increasing their mortgage by taking credit loans, but you should be careful as this investment method can be a penny autobahn.

Derivatives from DeFi

The leader in DeFi derivatives services is the Synthetix project.

What can be done if these derivatives come into DeFi? The simplest example would be to trade derivatives of equity instruments. Synthetix project's overwhelmingly No. 1 platform for derivatives is to trade stock products such as Apple and Tesla as derivatives on the blockchain. Why should you do it with a blockchain? If you think about it, the reason that comes to mind right away is that there will be an inconvenience with the unit currency swap (for Koreans, for example, KRW-USD). It could be the reason to receive a loan service as a cryptocurrency asset (buy Tesla by receiving a mortgage loan with ETH), and other dark reasons also remind me of tax evasion.

Perhaps you may or may not agree with the incentives to use DeFi derivatives services. Still, in this article, I think it's worth using it. Even so, there are still some problems to solve. First, how to give the value link between derivatives and spot products? Second, who will tell you the value of the spot product? Solving these two problems is the key to determining the success or failure of the DeFi derivatives platform.

Sustainability of the futures market without maturity

What makes the futures market weird without maturity is that there is no suppressor of value linkage. If there is maturity, if there is a date when the actual contract is concluded, the closer the date is, the higher the correlation with the spot market value. Whether the value of the futures market follows the spot market or the spot market reverses, it will converge. This is because there are people who enter for arbitrage. So, as the maturity is near, the price difference between the two is narrow. As an aside, the size of this spread is largely correlated with interest rates as well.

But what if there is no maturity? It's like there is no suppressor. There is no good incentive for the futures market price and the spot market price to be the same. But what's interesting is that in BitMex's futures market, the price of BTC futures and spot BTC remain almost the same. I don't know in detail how the values between the two are connected, but it is definitely noteworthy. It makes sense in itself that a futures product doesn't have to expire.

The Synthetix project is also trying to create an endless futures market. Of course, the goal is to create a decentralized market linked to the spot stock market, so there is no maturity. Because spot stocks belong to centralized finance, it would be very difficult to maintain decentralization and link with DeFi derivatives. But, as I said earlier, futures without maturity have inherent risks. It will be essential to put a sustainable economic mechanism into this cryptic market and test it if it actually works.

Gears of the Synthetix project

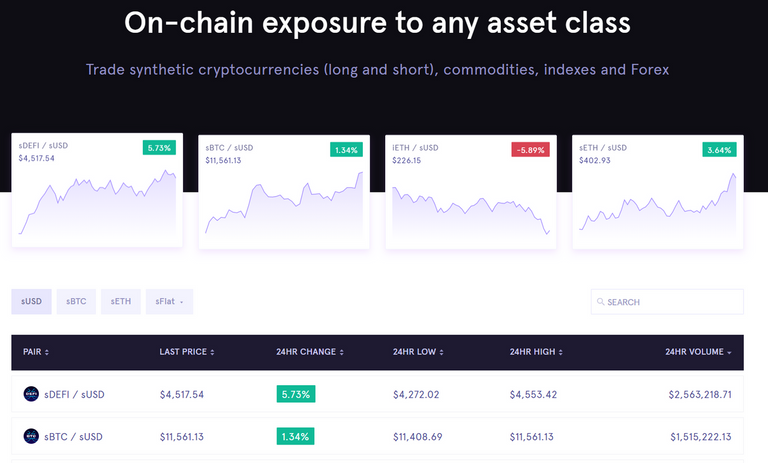

This is what the Synthetix Exchange platform looks like. The sDEFI indexed index fund product stands out.

The Synthetix project is testing its potential by activating the cryptocurrency futures market. It seems to work well for cryptocurrencies as of the current time. In the figure, sBTC is a product corresponding to BTC long, and iBTC is a product corresponding to BTC short. As of the present time, sBTC price is 11561.13$ and spot sBTC is 11550$, so you can see that the spot value is followed with quite high accuracy. Interesting. What incentives did he give you?

Take the derivative sETH made by Synthetix as an example. sETH, as the abbreviation s, is a token that follows the value of ETH spot assets, meaning that it is issued on the synthetix platform. The issuers of sETH are market participants who have staked Synthetix tokens (SNX). Freezing SNX tokens and issuing sETH tokens means that the issuer owes'debt' to the system. Like MakerDAO, you must return the issued sETH tokens to get the frozen SNX tokens back. The white paper talks about a number of protocols for linking sETH values. Mechanisms that seem personally relevant are:

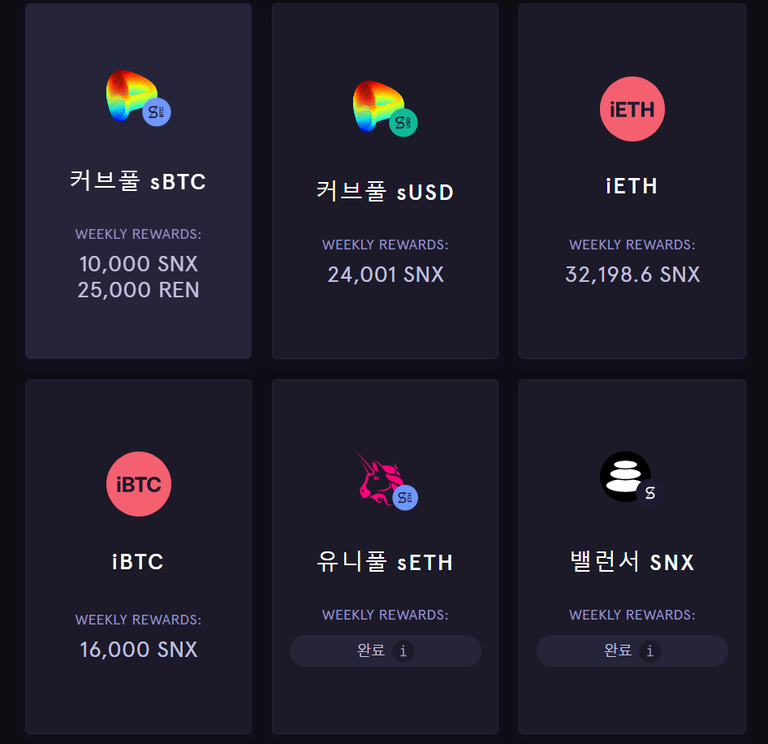

The incentive payment for the Uniswap sETH-ETH pool is complete.

First of all, Synthetix's value retention protocol requires an ETH-sETH liquidity pool (AMM-based DEX). In order to give incentives to form this liquidity pool, a certain amount of incentives (SNX tokens) are paid weekly to the liquidity pool. If the sETH value guaranteed by this liquidity pool is much lower than that of ETH, the arbitrage trading algorithm is executed. Buy 1 sETH from this pool using 0.99 ETH. 1 sETH bought in this way can be exchanged with SNX for full value (the market value of ETH spot). The SNX used to be paid for this exchange is a newly issued token as part of the incentive that was previously said to be paid. The received SNX is exchanged for 1ETH again, leaving a margin of profit (0.01ETH gain!).

It means that the value is maintained in a roughly very difficult and risky method (trick).

The final puzzle, Oracle

An Oracle system is also required for the Synthetix protocol to function properly. This is because the market value of the spot ETH, which has been continuously mentioned above, needs to be communicated. It wouldn't be possible if someone could manipulate this price at will. Currently, Synthetix is working with Chainlink's Oracle project to get the value of in-kind assets. In this way, there is a part that makes sense of the explosive price increase of Chainlink coins. Decentralized trading of real financial assets using Oracle may not be such a distant future.

What I felt during my study was that the risks of the Synthetix project were greater than I thought. Perhaps the biggest risk is the value linkage of derivatives. It is questionable how much tolerance can be made to the sudden value fluctuations of the collateral SNX token. But the hopeful thing is that there has been no problem so far. However, there seems to be a need to be careful. In the next article, I will study Oracle systems. As for Oracle, I haven't done any studies, so I think it may take some time to post.

You recently registered as a recommended artist, but thank you for your support ^^ I will try harder to deliver accurate and substantial information! Everyone is in good health.

Posted Using [LeoFinance](https://leofinance.io/@chilok/2l5brk-knowing-decentralized-finance-defi-right-away)

Congratulations @chilok! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz: