Housing Prices In Sydney Going Crazy!

Hi Everyone

As some of you are aware, I have been looking for a property for some time and finally we have settled on a place, this will be family home for now. During these few months, the prices of the housing market has been crazy due to the virtually “no” interest rates. When I say that, it literally means a small amount the rate from the reserve bank is set at 0.1%. Really?!?! Back in the days over 20 years ago, my parents were paying around 16-17% interest rate alone and I remember my dad said this repayment is mostly interested and only $20 is the principle. No joke! I was thinking back then why buy a house if you are just paying the bank just interest. I also questioned will my dad ever pay off his house??!?!?! Fast forward 20 years here I am virtually paying 1/10th of what he paid in interest.

People now days see the opportunity to buy a house with these low rates. With low interest rates also means money in saving accounts will get you peanuts. People rather put their money into property with the hope it goes up in value rather than leave it in the bank getting a few dollars a year hence why people are crazy with property. With overseas investors mostly out of Australia (our boarders are mostly closed), all these prices are driven up by local buyers. In 2017 most of the higher prices are driven up by investors therefore this time is slightly different.

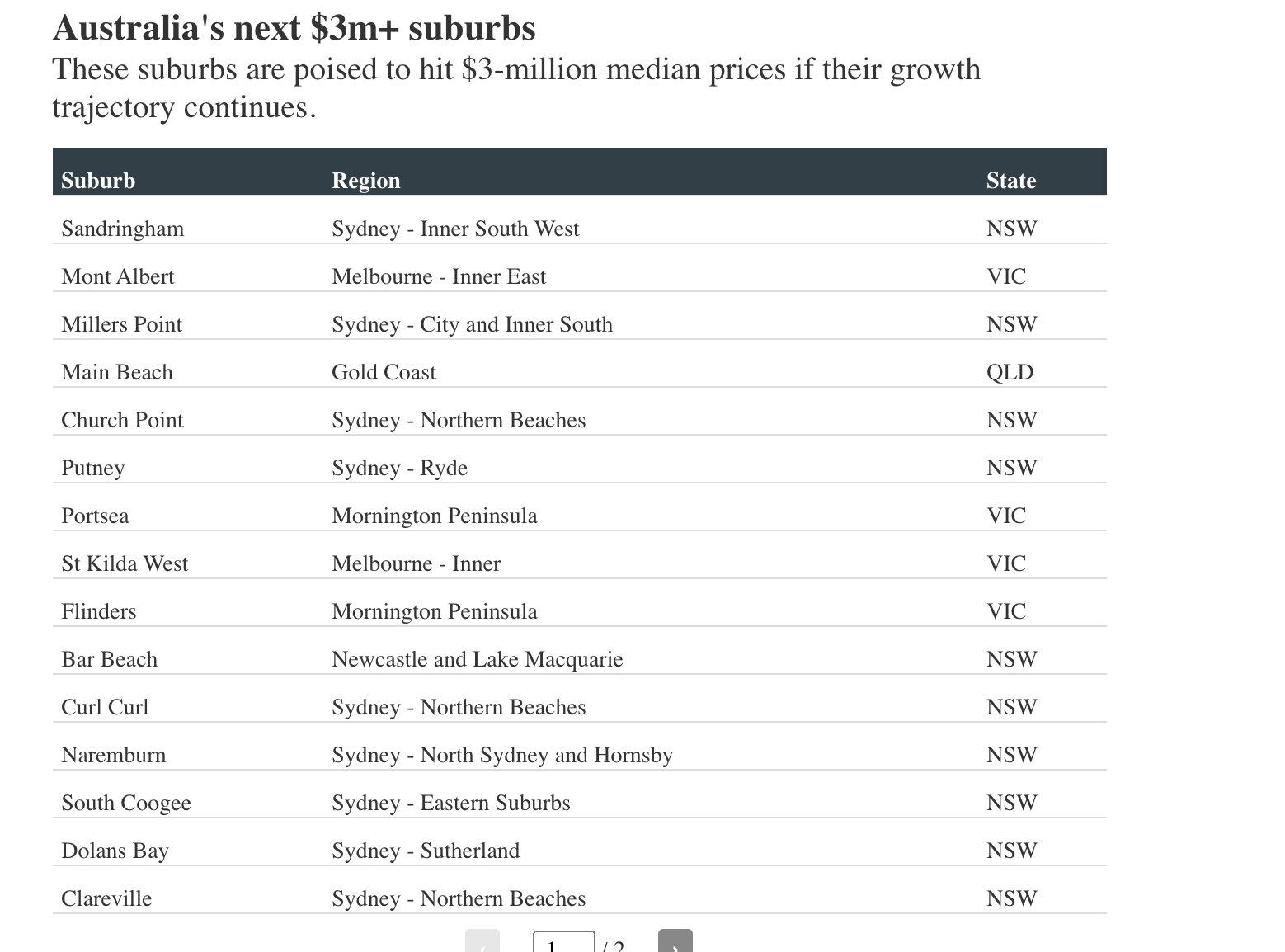

Clearance rates are as high as 96% in the North Shore with many properties are sold prior to auctions with a ridiculous price. In the papers, you don’t see any more of the next million dollar suburbs, we are seeing which are the next 3 million suburbs. Yes 3 million! If you see the list below, most of these suburbs are in the NSW and then Victoria with these two states being the most populated. The COVID pandemic didn’t slow down our housing market, in fact it has probably pushed it up higher with the combination of low interest rates and people are stuck within the country and cannot spend their money so putting their money into housing seems the more ideal way at the moment.

animation by @catwomanteresa

Thanks for reading. If you like my post, please follow, comment and upvote me. There will be more exciting posts & destinations to come.

All photos & videos are taken by me & co in all my blogs/stories unless quoted.

Posted Using LeoFinance Beta

Great to hear you found the home you were looking for, accelerated buying conditions with low interest rates come rarely.

Investing into a home is always better than paying rent, now to plan on paying off as quickly as possible or having a safety net to hold should interest move in the opposite direction.

Lets hope we will be ok as some places we have seen are still cheaper to have a mortgage. Also depends if you are paying principle or interest only loans

!ENGAGE15

We hit a bad patch when interest on loans went sky high well over 20%, it was a case of tighten you belt and try pay off as fast as possible.

Interest takes up most of the principal loan payback depending on loan duration. Finding the right place also had massive impact, buying via a banking establishments originally we then moved to a new home loan financing company established in 1999 who charged far lower rates.

ENGAGEtokens.Massive money printing means fiat currencies are collapsing.

That is reflected in prices of assets that are genuinely scarce.

Sydney residential property is one of those.

I see my old suburb of South Coogee is on the $3M list.

I’m glad my ex-wife (and ultimately my kids) will do well out of this.

Israel has also seen strong property price growth.

Eastern suburbs have always been popular. I guess where they are living in is currently hot right now!

!ENGAGE15

ENGAGEtokens.Perhaps this is primarily due to supply and demand

Posted Using LeoFinance Beta

Yes that is also true, less sellers but more people trying to get these low interest rates.

!ENGAGE15

ENGAGEtokens.That is awesome that you found a place. The market has been crazy over here too. We had rates down in the 2% range. I think my wife and I's original rate was just under 4%. Many people have been taking advantage of the low rates and refinancing their mortgage. Houses are flying off the shelf here too. When a new one comes on the market it has at least five offers by the end of the day. It is driving prices up drastically.

Posted Using LeoFinance Beta

Yes refinancing is also popular I heard or making it fixed loan. Supply is so little at the moment and sellers are ultra greedy as they know they have the upper hand.

!ENGAGE15

Yeah, for sure. That is how it is here too. My wife and I figured we could sell our house for about $50k more than what we bought it for at least, but then we wouldn't have anywhere to go because all the other houses on the market are selling so fast!

Posted Using LeoFinance Beta

ENGAGEtokens.ohhh it's great that you find a house! i remember the first posts when you were still in search!

Posted Using LeoFinance Beta

Oh yes it took forever it seemed but glad we found one!

!ENGAGE15

ENGAGEtokens.property is all good but when/if a few billion people disappear the housing bubble will pop. Investing in property is deemed such a certainty right now that a change in that trend is long over due.