Could one mitigate the impermanent loss by using the staking Pool on Robiniaswap ?

Getting to Know Robiniaswap

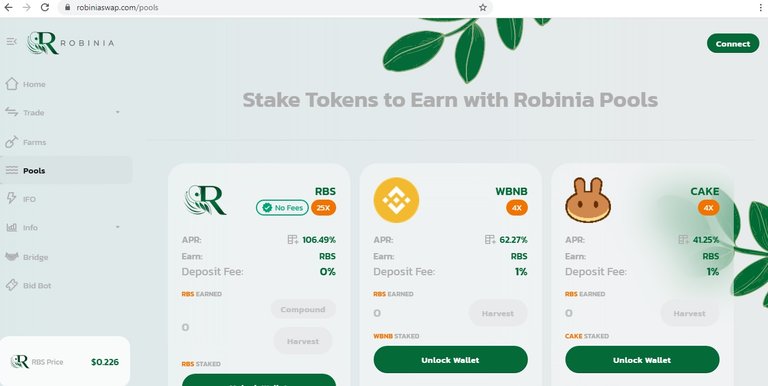

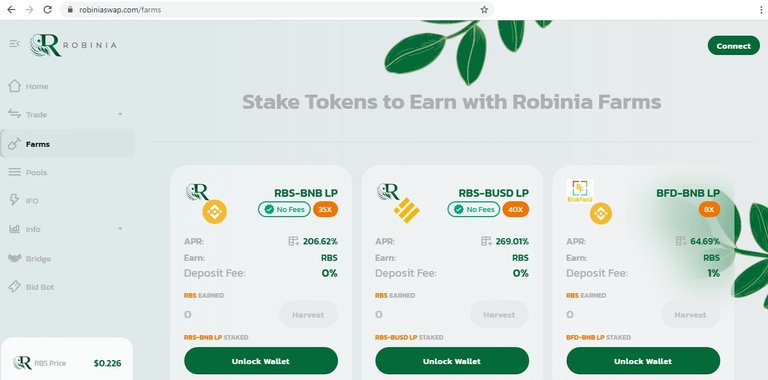

Robiniaswap is a DeFi platform that provides two kinds of investing opportunities currently that is Pool staking available via

https://robiniaswap.com/pools

and farm investing opportunities available under

https://robiniaswap.com/farms

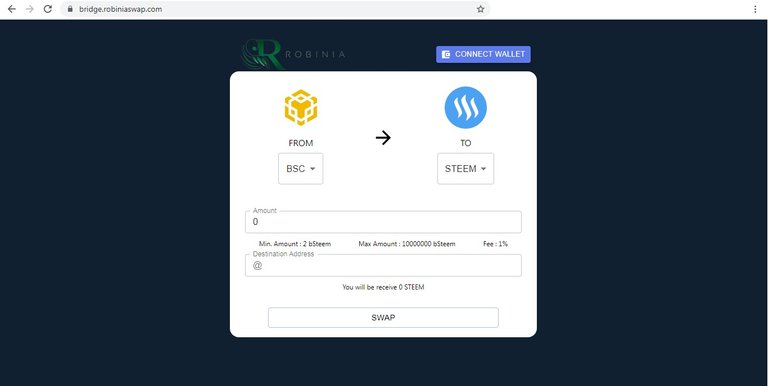

It also provides a bridge service to convert STEEM and BLURT tokens from there respective blockchains to be moved to BSC (Binance Smart Chain) so that they can be invested.

This can be done on the https://robiniaswap.com website using the Pool and Farm options.

This is a two way bridge that helps move crypto both ways from STEEM/BLURT to BSC and

from BSC tokens to STEEM/BLURT

The service can be accessed at

https://bridge.robiniaswap.com/

It is a service which takes a 1% fee and the RBS tokens equivalent to the fee are burned periodically. This helps in a gradual price appreciation.

However if you are into DeFi then you might have heard about Impermanent loss. In this post we try to explore the possibility to reduce or mitigate it by using the pool on https://robiniaswap.com

What is impermanent loss ?

When you provide liquidity to a liquidity pool and the price of your deposit changes over time that is in comparison to when you

deposited them this is impermanent loss.

As prices can move both ways if they move up it is a profit but if they move down it is a loss.

However this impermanent loss is only notional since you have not yet liquidated your position.

If this loss were to get reversed as a result of the asset value going up it would no longer be a loss.

However sometimes a user may liquidate his position while his assets value is in the red as compared to his buying price.

In such a case the loss becomes permanent and no longer remains impermanent.

How the Pool works?

It determines the price of its assets based on the

Most pools theses days work on the principle of AMM an automatic market maker.

Here the product of the two assets is multiplied to arrive at a constant value and this is maintained constant.

Where the assets value is determined as a ratio that varies to maintain the constant.

Let us understand it with an example

Suppose Joe has 2 BNB to start with.

He wants to deposit in the BNB-BUSD Pool

To do this Joe converted his 1 BNB to 100 BUSD

Suppose Joe Deposits 1 BNB priced at $100 and 100 BUSD priced at $1 each.

So technically 1 BNB = 100 BUSD at the time of investing in the pool.

This is based on the idea that Joe needs to add two assets of equal value to the pool.

Now suppose there are in total 10 BNB and 1000 BUSD in the pool so

Joe would have and holding of 10% share of the pool.

Hope things are clear till this point.

Now suppose the price of BNB climbs to 400 BUSD

So this creates an opportunity for arbitrage as traders can buy the BNB in the pool by adding BUSD

A Point to be noted since this is an AMM based pool so a trader would not be trading against another trader instead it would be a trade managed by the AMM market algorithm.

(So sometimes u see insane prices )

A thumb rule to understand how prices of the two accets move in the pool can be determined by ratio of two assets in the pool.

The pool mechanism is based in such a way that the ratio chages but liquidity remains constant.

If we take this liquidity constant as "k" then

K in our case would be 10 BNBX1000 BUSD = 10000

So this 10000 figure needs to be maintained at all times

Now suppose there are 5 BNB and 2000 BUSD in the pool

K remaining same as 5X2000 = 10000

Now Joe wants to take out or withdraw his 10% share

so he gets 10% of pool BNB that is 0.5 BNB

and 10% of BUSD that is 200 BUSD

So the combined value of his holding would be $200 (due to BNB ) and $200 due to BUSD

That is a total of $400 = 1 BNB (which is the current BNB price)

Now looking back Joe started with 2 BNB

So if he held on to his 2 BNB with current market price of $400 USD per BNB.

This would mean he could have held on to his BNB and have a net worth of $400X2 = $800

At times for providing liquidity you earn some trading fee that gets distributed for providing liquidity.

For the sake of simplicity of understanding one can avoid taking it into account.

However in real life scenario the additional income could help taper off and mitigate some part of the impermanent loss.

How to calculate the impermanent loss

Take into account the K for the pool

Find the ratio of pool you hold at the time of investing

at the time of liquidation calculate back the value of your original asset.

If it sounds complicated let me give you a vague idea if you are OK that we ignore the fee etc

1.25x price change = 0.6% loss

1.50x price change = 2.0% loss

1.75x price change = 3.8% loss

2x price change = 5.7% loss

3x price change = 13.4% loss

4x price change = 20.0% loss

5x price change = 25.5% loss

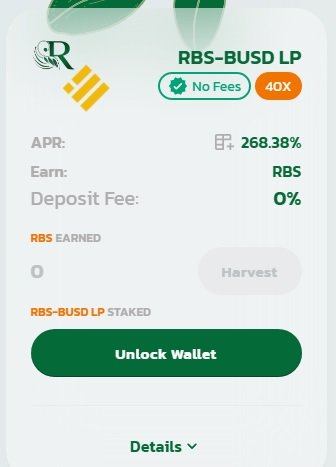

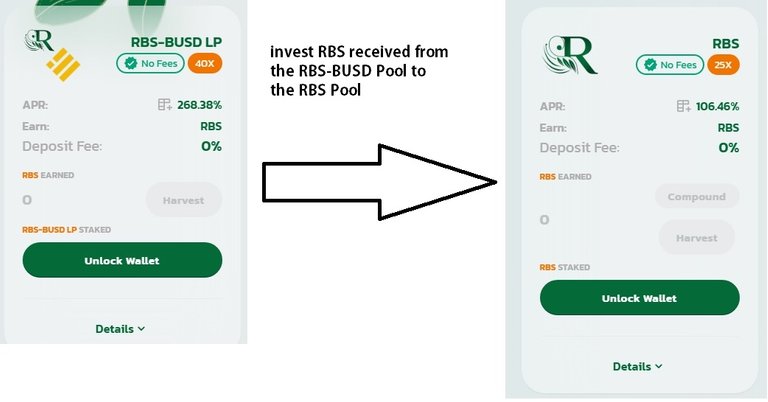

Now in the context of RBS that is the native token of the https://robiniaswap.com platform one finds that the price is already hovering around the $0.21 Mark so if one were to stake it in the RBS- BUSD farm one could get a handsomely attractive APR of 268.38%

If the price of RBS stays constant in this for the RBS- BUSD pool would behave like having 2 stable coins if this case holds the price range then there would be hardly any impermanent loss. ~ Though this may not actually play our or maybe it does only time would tell.

Secondly the impermanent loss is a notional concept that becomes actual and permanent only if the liquidity is removed and the loss is booked.

With the current high APR one can keep holding the LP for a long period and get a good return.

Thirdly if one were to remove the liquidity and have any loss then in that case one could use some of the RBS tokens gained to invest in the RBS pool under

https://robiniaswap.com/pools

For more information refer the project links

RobiniaSwap

https://robiniaswap.com/

Robinia Swap Audit Report.

https://github.com/TechRate/Smart-Contract-Audits/blob/main/September/RobiniaSwap.pdf

Robinia Swap Official Document: https://blokfield.gitbook.io/robinia/

Discord Channel: https://discord.gg/JYNVSuWFF7

Global Telegram Channel: https://t.me/officialrobinia

Korea Telegram Channel: https://t.me/robiniakr

Kakao Talk 1:1 Inquiry: https://open.kakao.com/o/s9uEwEyb

Business Partnership: [email protected]

Standard Disclaimer: Please do your own due diligence and research before making an investment. The purpose of this post is for educational purpose only and it should not be considered as financial advice.