How To Save Money & Become Rich

Everybody has goals like bucket list of places to go, reaching to the top of corporate ladder, trekking to some hard places, friendship goals etc and all these start from a very young age. Then why we don't keep a goal of saving money from young age.?? Why do we always make it a thing of after 30's.

Just like " Early to bed-Early to rise" it's same with money matters "Early to save-Early to rich".

And even when we start we are not able to. why?? Let me show you.

We receive the message salary credited to your account **************** and we go gaga and with a passion to save money from this month onwards and start the calculations.

Income - Expenditures = Savings. Done. NO NO NO NO.....!!!!!

Here is what we get wrong.

It should always be

Income -Saving = Expenditure

Yes it should always be this cause this way we can control our expenditures. Now the question is if we keep aside the saving first we have to know how much is that?!

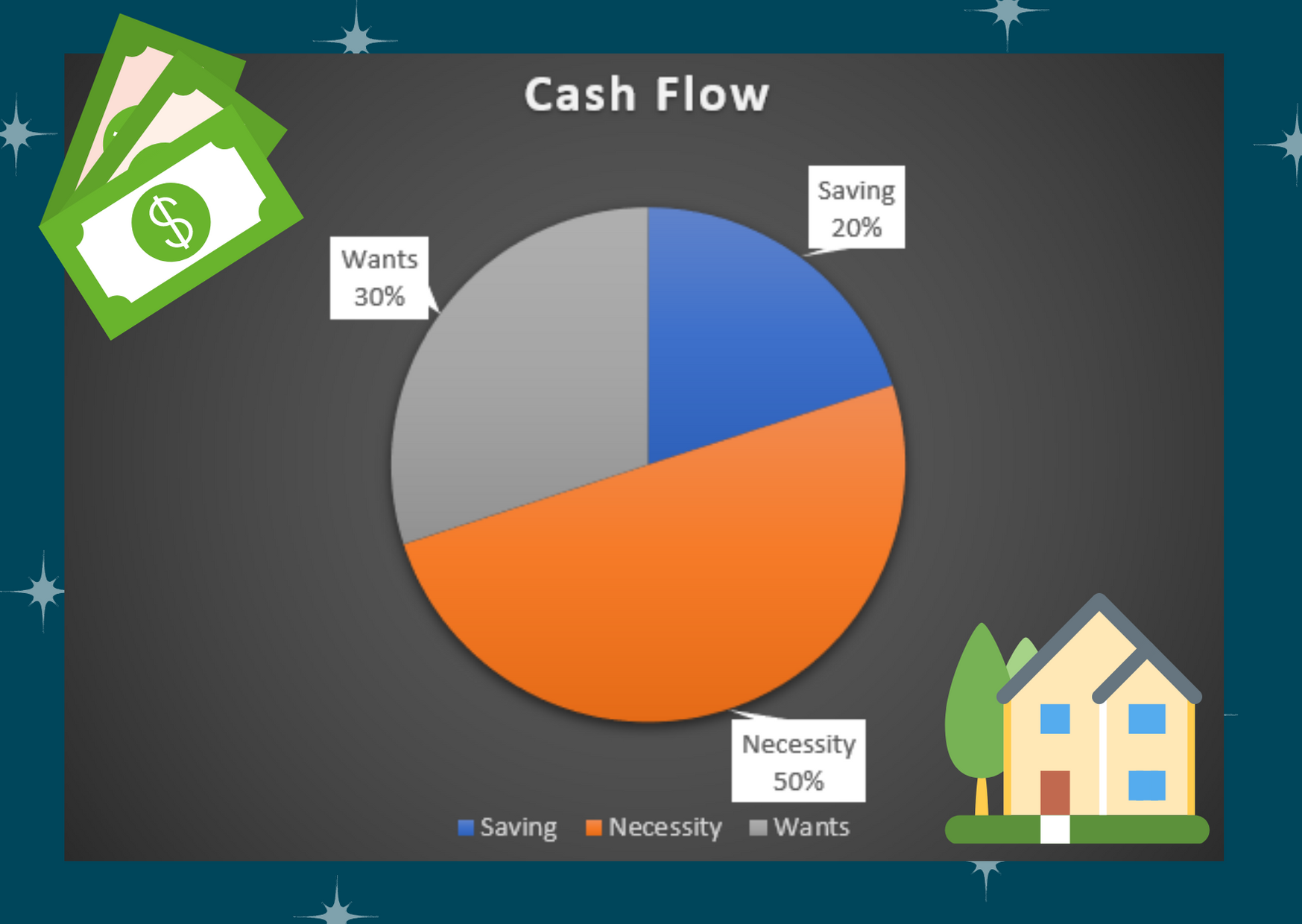

20% of your income should be always saved

50% should be allotted for the needs- Rent, electricity, grocery, internet payment etc. They are fixed i.e approximately these are your fixed expenditures and they remain averagely same.

30% for your enjoyment- watching movies, shopping, travelling fund. This is for pampering yourself. If you only work and work you can be bored or even worsen depressed, so enjoying by pampering yourself is a very vital step which should not be compromised for saving.

Reading through this you may think "that's it!! I know this-this is so basic and so naïve-everybody has this much common sense". But you will be surprised to know that maximum youngsters don't, rather they are not able to stick to. And all because of their uncontrollable expenditure. I'll definitely cover all the fancy/complicated strategies in coming future. However always stick to base.

You stick to base, everything will run on it's pace.

IF one follows this he/she can take a chill about retirement plans. Rest.

Posted Using LeoFinance Beta

I would prefere 50-40-10

40- save

10- fun n joy

Posted Using LeoFinance Beta

That shows how aggressive and responsible saver you are!

I really appreciate your decision. Money is important for today's world that's why the more you save it, the more you get benefit out of it

You must be a wise soul :D

Posted Using LeoFinance Beta