"brave army" Grayscale

In the three months ending 2020, apart from "crazy", there are no other words to describe Bitcoin. Bitcoin as a whole shows a linear uptrend, breaking its previous high in one fell swoop and doubling it again to hit a record high of $ 41,950. According to CMC statistics, from October 1 to December 31, the increase in Bitcoin in the fourth quarter reached 168.33%, and the monthly increase in December was almost 50%, which is also the highest Bitcoin increase in the single season since 2017., The highest monthly increase. Looking at the entire crypto market, only Bitcoin has achieved such a rise.

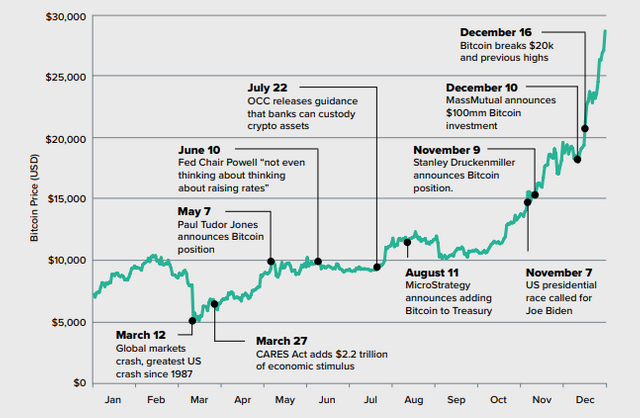

Overall Bitcoin 2020 review, source: Grayscale

Why did Bitcoin suddenly burst in the fourth quarter of 2020, and the bull market came so aggressively? Combining market views in recent months is no more than three points:

1. Bitcoin third halving, the supply relationship changed, Bitcoin's annual inflation rate in the next few years is only 1.8%;

2. Global financial markets are unstable, and hot money tends to use Bitcoin as a hedge fund;

3. Institutions continue to flood the crypto market with large amounts of funds, and Bitcoin, as the best target, naturally skyrocketed.

In fact, in summary, the most important point is point three, with the first two points being the foundation that attracted institutional investors to Bitcoin. Among these large institutional investors, Grayscale has been the most watched institution and is considered the driving force behind the bull market - the "bull market machine 2020".

As an indispensable force in the crypto market, who is Gray? I think as long as investors have been paying attention to currency circles this year, they all know about Grayscale. As one of the largest cryptocurrency asset management companies in the world, Grayscale was founded in 2013 with the support of digital currency investment group DCG. As of January 15, the total assets under management have exceeded US $ 27.7 billion, of which the Bitcoin trust scale is approximately To 23.4 billion US dollars, accounting for 85.55%.

On the evening of January 14, Grayscale released its investment report for the fourth quarter of 2020 and released a series of data, fundamentally reflecting the development momentum of the crypto market. Overall, the inflow of funds from Grayscale achieved substantial growth in Q4 2020. In Q4, Grayscale attracted a total of US $ 3.3 billion and 93% of investment came from institutional investors. Annual inflows of funds amounted to USD 5.7 billion, representing the cumulative inflows for the previous seven years. Funding (US $ 1.2 billion) more than quadrupled; If you look at the whole of 2020, the asset management gray scale is only 2 billion US dollars at the beginning of the year, and reaches 20.2 billion US dollars at the end of the year.

Overall, the gray scale of 10-fold growth tells us: Institutions are strong and the bull market continues.

Q4 Capital growth has flowed in, with institutional investors exceeding 90%

Horizontally comparing each quarter of 2020, Grayscale's asset management scale grew the fastest in Q4, which is exactly the same as Bitcoin's K-line growth. The market generally believes that the continuous improvement from Grayscale in Q4 has brought a bullish market in Bitcoin.

Grayscale experienced unprecedented investor demand in Q4 , with total capital inflows of around US $ 3.3 billion during the quarter.

2020Q4 Gray cumulative inflows by product

As shown in the figure above, in Q4, the average weekly investment of all trust products was around US $ 250.7 million, ofwhich Bitcoin Trust contributed US $ 2,171, accounting for around 86.6% of the total. Throughout the quarter, funds flowing into the Grayscale Bitcoin Trust hit a record high of $ 2.8 billion. In December, the inflow of funds from Bitcoin Trust hit an all-year high. Compared to the price of BTC, Bitcoin increased by more than 40% in one month in December.

The average weekly inflow from Ethereum Trust is US $ 26.3 million. As of the end of November, there were significant investment inflows. The investment demand from the Ethereum Trust increased sharply, which increased the average weekly investment inflow. This may be closely related to the launch of the ETH 2.0 mainnet. In the first two weeks before the launch of the ETH2.0 genesis block, the ETH received by the Ethereum 2.0 deposit contract address jumped in a short time, and the promise jumped to 750,000 ETH. As of January 15, more than 2.5 million ETH have been pledged in the Ethereum 2.0 contract, the price of ETH has also jumped more than 40% in a short period of time in January 2021, reaching a new high since February 2018, at $ 1,348.

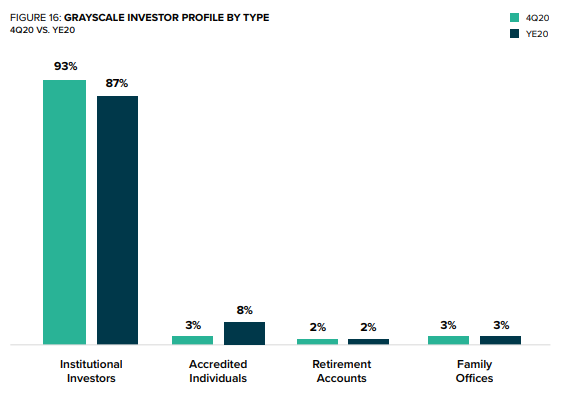

Grayscale investor profile by category, 2020Q4 vs 2020 full year

From an investment group perspective, Grayscale users are still mostly institutional investors. In Q4, 93% of investment came from institutional investors, particularly asset managers, with inflows of around US $ 3 billion. This is consistent with the Bitcoin trend where Wall Street and other institutions began to enter the market at the end of 2020. Average purchase volume between institutions also increased at a significant rate. The average purchase volume of institutions in Q4 was US $ 6.8 million, an increase of 130 % compared to US $ 2.9 million in Q3.

And Bitcoin confidence accounts for 87% of the total inflow of Grayscale products, which is the highest proportion since the second quarter of 2017, which further confirms that there is no doubt that institutional investors treat Bitcoin as a reserve asset, and an institutional investment. This is the basis of the Bitcoin bull market.

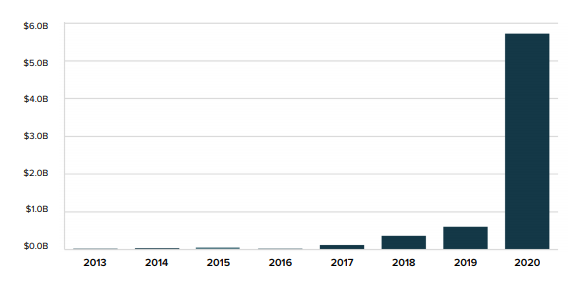

The total inflow of funds was 6.9 billion US dollars, and the total scale of asset management was 20 billion US dollars

The report shows that as of December 31, 2020, Grayscale had an estimated inflow of US $ 5.7 billion over the year, more than four times the cumulative inflow of funds (US $ 1.2 billion) in 2013-2019. At the same time, Bitcoin's overall increase in 2020 (the minimum Bitcoin price in 2020 was $ 3791 and the maximum price was $ 41,950) was also greater than the previous year. Since the founding of Grayscale in 2013, nearly US $ 6.9 billion has flowed to Grayscale products.

Grayscale annual growth rate from 25 September 2013 to 31 December 2020

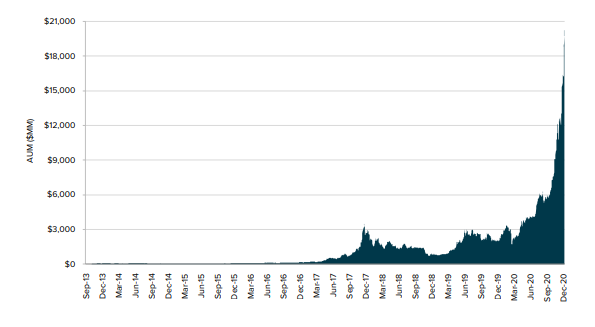

With the overall increase in cryptocurrency prices and large-scale inflows of funds from institutional investors, Grayscale's managed assets hit record highs in the fourth quarter of 2020. In early 2020, Grayscale's asset management scale was still only US $ 2 billion, and at the end of the year it was soaring. up to US $ 20.2 billion, an increase of more than 10 times. Grayscale Asset Management's rapid growth is mainly due to Bitcoin Trust. At the start of the year, the Bitcoin Trust scale was only US $ 1.8 billion, and had increased to US $ 175 by the end of the year.

Grayscale asset management scale since its inception in 2013

2020: Grayscale and the year behind Bitcoin

According to the quarterly investment report released by Grayscale, the scale of Grayscale's asset management has grown from about US $ 607 million in the fourth quarter of last year to around US $ 12.572 billion in the near term, a 20-fold increase. Looking back at Grayscale's quarterly report, Grayscale will point to accelerated developments in 2020. At the same time, 2020 is not only a turning point for Grayscale, but also a turning point for Bitcoin, and institutional investors are the key to a turning point.

Goldman Sachs executive Jeff Currie recently stated that the large-scale adoption of bitcoin by institutions has put the asset on a path to maturity, but bitcoin still has a long way to go before it is recognized as an institutional-level asset.

In 2020, the gray scale team will consist of at most 20 people, and the asset management scale is 20 billion US dollars. According to one percent, one percent management fee is 200 million US dollars, and per capita management fee is 10 million US dollars. Of course this does not include dividends.

It is believed that more and more people will follow the "Pixiu" branded operation, but there are serious inequalities between supply and demand in the amount of liquid bitcoin and bitcoin production capacity in the market. When the inequality between supply and demand continues, Price will fluctuate greatly, and there is no way to follow the logic of K-line trading, and the market will have a callback from 40,000 US dollars to more than 30,000 US dollars in 2 days.

Regardless of the ups and downs, Bitcoin will remain, and price volatility will continue. As an increasingly rare existence, whether institutional investors or retail investors choose Bitcoin in the crypto market will not be wrong at all.

Wonder why you see this?

Read here and here.

Posted Using LeoFinance Beta

I've just discovered your blog from the promoted section (so there we go, promoting your blogs works haha) and I love what I see. Good to have another long form content creator in the LeoFinance community.

My only tip is that you definitely should be publishing your posts from the leofinance.io front-end. This will allow you to keep all of the LEO author rewards that you're entitled to.

Who doesn't want more LEO, right? ;)

As for your post, I have a few comments.

Grayscale's demand for Bitcoin seems insatiable and being part of Bitcoin's very nature, the supply side can't keep up. The only place for price to go here is up and that's exactly what we've seen.

What I love most about this little bull run that we're seeing, is that retail money really hasn't come back in yet. Say institutional demand led by Grayscale can push price a little bit higher, I can see the retail rush coming in above 50K. A nice round number that people are drawn to that can't be ignored.

Do you have any indication of what 2021 flows for Grayscale look like?

Posted Using LeoFinance Beta

By 2021, people are adopting digital assets to accelerate growth, Grayscale hopes to continue serving the investment community, And make Bitcoin a guarantee for investors' portfolios.

Posted Using LeoFinance Beta

Congratulations @quinngrey! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP