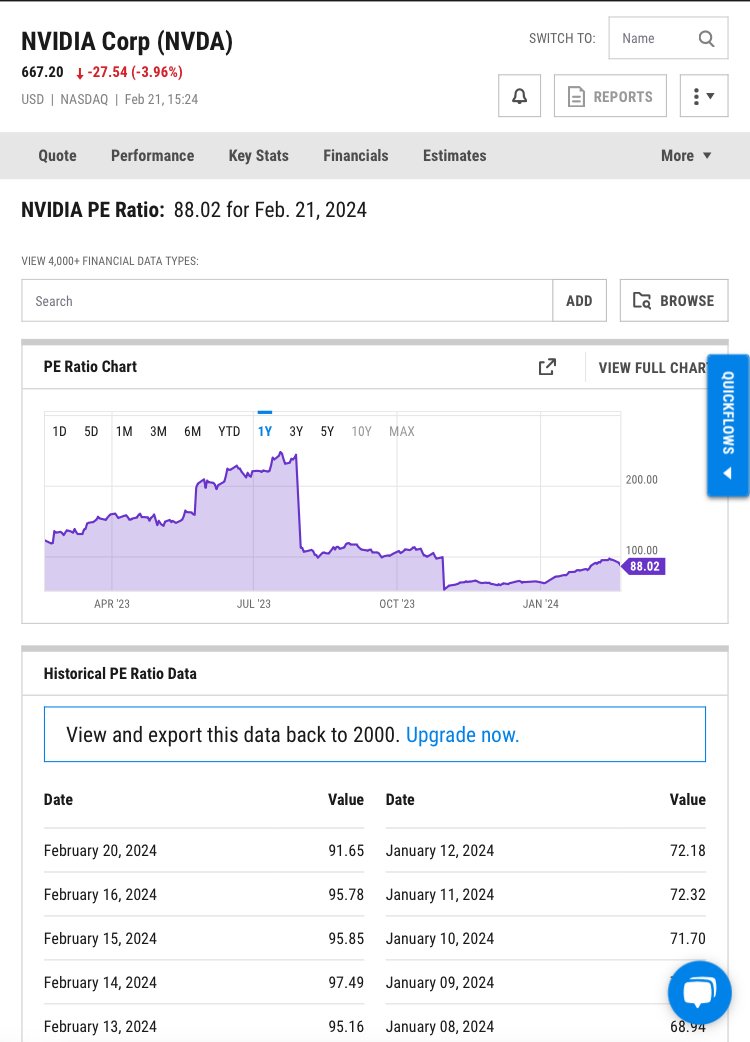

Why I stay away from Nvidia and its high price/earnings ratio!

P/E ratio of 90

In the fast-paced world of investing, the allure of high-flying stocks like Nvidia can be irresistible. With groundbreaking innovations, strong market presence, and promising future prospects, companies like Nvidia often dominate headlines and catch the eye of eager investors. However, behind the glitz and glamour lies a hidden danger that can wreak havoc on portfolios: the sky-high price-to-earnings (P/E) ratio. In this blog post, we'll explore why investing in stocks with excessively high P/E ratios, using Nvidia as a case study, can be a risky endeavor.

Firstly, let's understand what the P/E ratio represents. The P/E ratio is a fundamental metric used by investors to evaluate a company's valuation relative to its earnings. It is calculated by dividing the stock price by the earnings per share (EPS). A high P/E ratio indicates that investors are willing to pay a premium for the company's earnings, often driven by high growth expectations or market exuberance.

Nvidia, renowned for its cutting-edge graphics processing units (GPUs) and dominance in the semiconductor industry, has been a darling of investors for years. However, its astronomical P/E ratio has raised eyebrows among seasoned investors. As of [insert date], Nvidia boasted a P/E ratio of [insert ratio], far surpassing the industry average and signaling potential overvaluation.

Vulnerable

One of the primary risks associated with investing in high P/E ratio stocks like Nvidia is the vulnerability to market corrections. When investors bid up the price of a stock based on lofty expectations, any deviation from those expectations can trigger a sharp decline in the stock price. In Nvidia's case, if the company fails to meet or exceed the market's aggressive growth projections, investors who bought in at inflated prices could face significant losses.

Moreover, high P/E ratios can create a precarious situation during economic downturns or sector-specific headwinds. In times of uncertainty, investors tend to gravitate towards safer, more stable investments, causing high-flying stocks like Nvidia to experience heightened volatility and sharper sell-offs. Without a solid foundation of earnings to justify its lofty valuation, Nvidia could be particularly susceptible to such market turbulence.

Another concern with high P/E ratio stocks is the risk of a valuation bubble. Just as with the dot-com bubble of the late 1990s, investors can become caught up in the hype surrounding a particular stock or industry, driving prices to unsustainable levels. When the bubble inevitably bursts, as it always does, investors are left holding the bag as stock prices plummet to more reasonable levels. While Nvidia's innovative technology and strong market position may justify a premium valuation to some extent, the inflated P/E ratio leaves little room for error.

Furthermore, investing in high P/E ratio stocks like Nvidia can lead to missed opportunities elsewhere in the market. By allocating a significant portion of one's portfolio to overvalued stocks, investors may forego the potential gains offered by undervalued or overlooked companies with more attractive risk-reward profiles.

So, while companies like Nvidia may capture the imagination of investors with their groundbreaking technology and impressive growth trajectories, investing in stocks with excessively high P/E ratios carries significant risks. From vulnerability to market corrections and economic downturns to the potential for valuation bubbles, the dangers of overpaying for future growth cannot be overstated. As prudent investors, it is crucial to exercise caution and conduct thorough due diligence before diving into the world of high-flying stocks, lest we find ourselves on the wrong side of a costly lesson in market reality.

Sincerely,

Pele23

😉 well said. Yes, I also avoid.

Look at what happened to Tesla, from 950 p/e back to 50… Anything above 40 is a risk!

Yay! 🤗

Your content has been boosted with Ecency Points, by @pele23.

Use Ecency daily to boost your growth on platform!