Tesla Stock Plunges: Understanding the Impact on the Company

Tesla, over the top?

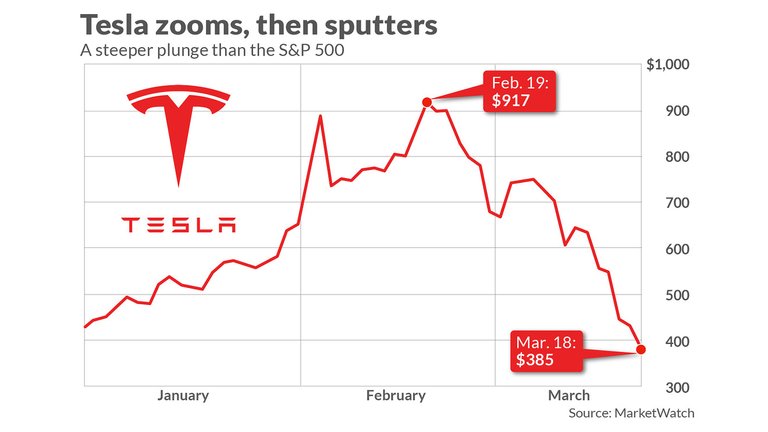

In recent days, Tesla, the electric vehicle (EV) pioneer, has witnessed a significant dive in its stock market performance, sparking concerns and discussions among investors and enthusiasts alike. The ramifications of this downturn extend beyond mere numerical fluctuations, potentially reshaping the trajectory of the company and the broader EV industry. Tesla’s stock plummet can be attributed to various factors, ranging from supply chain disruptions to concerns about the company’s valuation. The ongoing global chip shortage has plagued the automotive industry, leading to production delays and hindrances for Tesla. Additionally, rising inflation and interest rates have prompted investors to reevaluate high-growth stocks like Tesla, which often rely on optimistic future projections for their valuation.

One of the immediate consequences of Tesla’s stock decline is its impact on investor sentiment. Tesla’s stock has long been synonymous with market exuberance and investor confidence in the future of electric mobility. However, the recent downturn may erode some of this confidence, potentially leading to further sell-offs and volatility in the stock market.

Tesla’s stock performance can influence its ability to raise capital. As a company that has historically relied on equity financing, a prolonged period of depressed stock prices could make it more challenging for Tesla to fund its ambitious expansion plans, including the construction of new Gigafactories and the development of next-generation EV technology.

The decline in Tesla’s stock price also raises questions about the broader EV market. Tesla has been a bellwether for the industry, with its success often seen as a barometer for the adoption of electric vehicles worldwide. A sustained downturn in Tesla’s stock could dampen investor enthusiasm for other EV manufacturers, potentially slowing down the transition to electric mobility.

However, it’s essential to approach Tesla’s stock performance with a balanced perspective. Despite the recent downturn, Tesla remains a formidable player in the EV industry, with a loyal customer base, strong brand recognition, and a robust ecosystem of products and services. The company continues to innovate in areas such as battery technology, autonomous driving, and renewable energy, positioning itself for long-term success in a rapidly evolving market.

While Tesla’s recent dive on the stock market has raised concerns and uncertainties, it is crucial to view this development within the broader context of the company’s trajectory and the EV industry as a whole. The repercussions of Tesla’s stock decline extend beyond financial metrics, shaping investor sentiment, capital raising prospects, and the perception of electric mobility. As Tesla navigates through these challenges, its ability to adapt and innovate will ultimately determine its future success.

Sincerely,

Pele23

I think we are close to a technical turnaround now. The stock is massively oversold, like two years ago when suddenly we saw a big pump after we hit $100.

Maybe the chinese Ev's are giving tesla a tough time of late.

Just like that if the prices are going down then it is a buying opportunity for all of us.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.