Can we expect a real bull run after the halving?

Halving as a katalyst

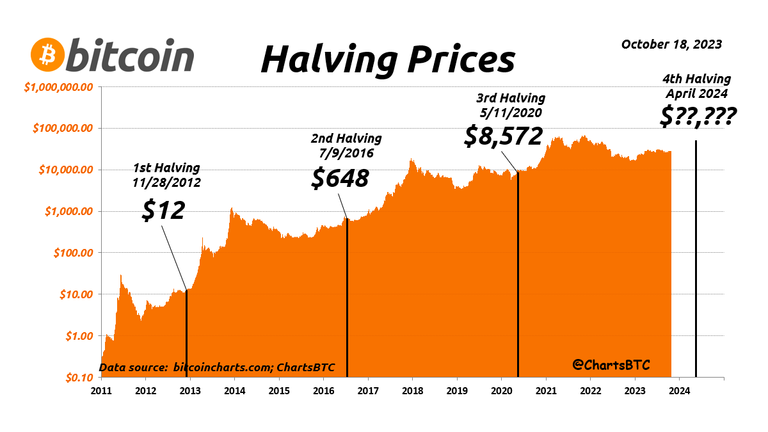

As the crypto community eagerly awaits the upcoming halving of Bitcoin, slated to occur approximately every four years, speculation runs rampant about its potential impact on cryptocurrency prices. Historically, Bitcoin halvings have been pivotal events, often triggering significant price movements and reshaping market dynamics. So, what can we expect this time around?

Firstly, it’s crucial to understand the mechanism behind Bitcoin halving. Every 210,000 blocks mined, the reward for miners is halved, reducing the rate of new Bitcoin entering circulation. This process is designed to control inflation and maintain scarcity, echoing the dynamics of precious metals like gold. As the supply diminishes, assuming demand remains constant or increases, basic economic principles suggest that prices could surge.

One prevailing theory is the “halving cycle hypothesis,” which posits that Bitcoin’s price tends to surge in the months following a halving event. This theory is supported by historical data, as both the 2012 and 2016 halvings were followed by remarkable bull runs. However, past performance is not indicative of future results, and the crypto landscape is notoriously unpredictable.

The market has matured significantly since Bitcoin’s inception, with institutional investors now playing a substantial role. This influx of institutional capital introduces a new dynamic to the equation, potentially dampening or amplifying the effects of the halving depending on their actions.

Another factor to consider is the broader macroeconomic environment. With global economic uncertainty looming, fueled by factors like inflation fears and geopolitical tensions, Bitcoin’s narrative as a hedge against traditional financial markets could strengthen, driving demand and price appreciation.

However, it’s essential to temper expectations with a dose of caution. Cryptocurrency markets are notoriously volatile, susceptible to manipulation, regulatory changes, and technological advancements. While the halving event may serve as a catalyst for short-term price movements, its long-term impact remains uncertain.

Additionally, the proliferation of alternative cryptocurrencies adds complexity to the equation. While Bitcoin’s halving garners the most attention, other coins may experience their own halving events or capitalization on Bitcoin’s momentum.

While the upcoming halving of Bitcoin is undoubtedly a significant event in the crypto world, predicting its precise impact on prices remains challenging. While historical trends and economic principles provide valuable insights, they are not guarantees. As always, investors should exercise caution, conduct thorough research, and be prepared for volatility in the crypto markets.

Sincerely,

Pele23

Yeehaw, partner! This here blog post is a wild ride into the world of Bitcoin halving, full of excitement and speculation. Remember, in the land of cryptocurrencies, stay sharp, be prepared for anything, and enjoy the adventure!

What makes this cycle different from previous ones is the fact that we already had a new ATH prior to the halving which imo is telling that this current one is more aggressive but also shorter-lived.

Could be, or it could also be an extreme run coming…

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

I can't imagine this so great and I hope it will really boast the process

View or trade

BEER.Hey @pele23, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.