Buffet, the oracle

The Philosophy of Warren Buffett: A Deep Dive into Berkshire Hathaway’s Approach

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has built his empire on a foundation of timeless principles and a unique investment philosophy. At the heart of his approach lies a commitment to long-term value investing, a focus on intrinsic value, and an aversion to speculation.

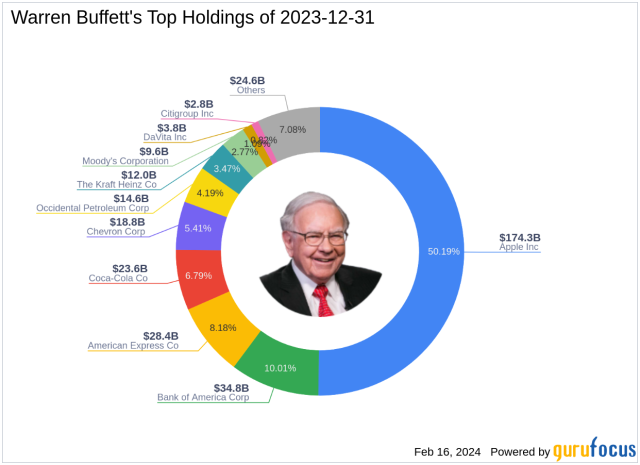

One of Buffett’s key principles is the concept of "buying wonderful companies at fair prices" rather than attempting to time the market or chase short-term gains. This approach emphasizes the importance of thoroughly understanding the businesses in which one invests and their long-term potential for growth and profitability. Berkshire Hathaway’s investment portfolio reflects this philosophy, consisting primarily of well-established companies with strong competitive advantages and reliable earnings streams.

Central to Buffett’s philosophy is the idea of investing for the long haul. He famously quipped, "Our favorite holding period is forever." This long-term mindset allows Berkshire to weather short-term market fluctuations and capitalize on the power of compounding returns over time.

Buffett’s emphasis on intrinsic value is another cornerstone of his philosophy. He famously distinguishes between price and value, asserting that while the price of a stock may fluctuate based on market sentiment, its true value is determined by the underlying fundamentals of the business. Berkshire Hathaway focuses on businesses with durable competitive advantages, robust cash flows, and competent management teams, which Buffett believes will ultimately drive long-term value creation for shareholders.

In addition to his focus on intrinsic value, Buffett is known for his disciplined approach to capital allocation. Berkshire Hathaway’s decentralized structure allows its subsidiaries to operate autonomously while benefiting from the financial strength and stability of the parent company. This approach enables Berkshire to invest in a diverse range of businesses across various industries, from insurance and utilities to manufacturing and retail.

Buffett’s aversion to speculation and his emphasis on rational decision-making have also played a significant role in shaping Berkshire Hathaway’s philosophy. He famously avoids investing in businesses or industries he doesn’t understand and maintains a conservative approach to risk management.

Overall, Warren Buffett’s philosophy of investing in quality businesses for the long term, focusing on intrinsic value, and practicing disciplined capital allocation has cemented Berkshire Hathaway’s reputation as one of the most successful and enduring companies in the world. As investors continue to navigate the complexities of the market, Buffett’s timeless principles serve as a beacon of wisdom and guidance.

Sincerely,

Pele23

Nice summary of this legendary investor. I like his approach in general but don’t like how sceptical he is when it comes to tech or bitcoin.

True, but he is an old man…

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @pele23, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

True too 🤷🏼♂️

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Such people are very prudent and time their investments to get a good return.