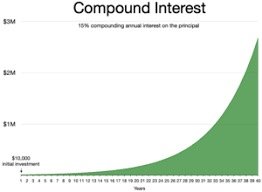

A few percentage points of interest make a huge difference!

6 %, 8% or Warren Buffet percentages?

What if you save 100 USD every month for 20 years and you get 6 % per year?

To calculate the future value of your savings with a monthly contribution of $100, an average annual percentage rate (APR) of 6%, and a savings period of 20 years, you can use the future value of an annuity formula:

FV = Pmt * (((1 + r)^n - 1) / r)

Where:

- FV is the future value of the savings.

- Pmt is the monthly contribution ($100).

- r is the monthly interest rate (6% / 12 months = 0.06 / 12 = 0.005).

- n is the total number of payments (20 years * 12 months/year = 240 months).

Now, plugging in the values:

FV = 100 * (((1 + 0.005)^240 - 1) / 0.005)

Calculating this yields:

FV ≈ $48,386.13

So, after 20 years of saving $100 per month with an average APR of 6%, you would have approximately $48,386.13.

Not bad at all, but what at 8%?

If the average APR increases to 8%, you can use the same formula to calculate the future value:

FV = Pmt * (((1 + r)^n - 1) / r)

Where:

- FV is the future value of the savings.

- Pmt is the monthly contribution ($100).

- r is the monthly interest rate (8% / 12 months = 0.08 / 12 = 0.00667).

- n is the total number of payments (20 years * 12 months/year = 240 months).

Now, plugging in the values:

FV = 100 * (((1 + 0.00667)^240 - 1) / 0.00667)

Calculating this yields:

FV ≈ $66,021.19

So, after 20 years of saving $100 per month with an average APR of 8%, you would have approximately $66,021.19.

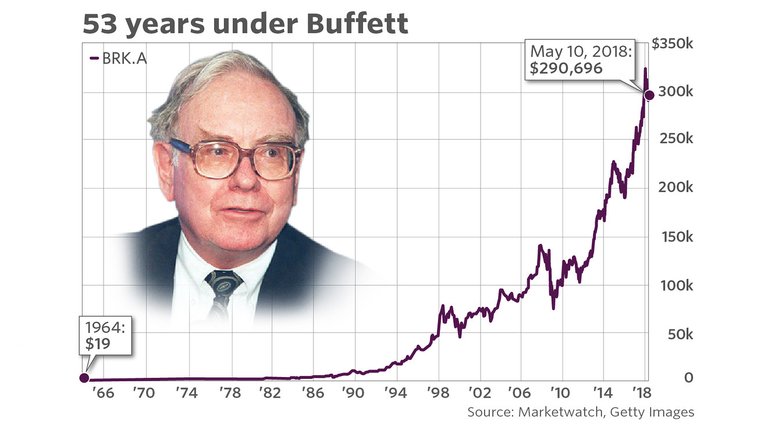

Looks even more decent, but what at 12 % APR, which is what Berkshire Hathaway has ad track record for the last 45 years?

Using the same formula as before, but with an average APR of 12%:

FV = Pmt * (((1 + r)^n - 1) / r)

Where:

- FV is the future value of the savings.

- Pmt is the monthly contribution ($100).

- r is the monthly interest rate (12% / 12 months = 0.12 / 12 = 0.01).

- n is the total number of payments (20 years * 12 months/year = 240 months).

Now, plugging in the values:

FV = 100 * (((1 + 0.01)^240 - 1) / 0.01)

Calculating this yields:

FV ≈ $152,191.64

So, after 20 years of saving $100 per month with an average APR of 12%, you would have approximately $152,191.64.

This is a huge difference, and shows once again how important it is to choose wisely where you put your money in!

Berkshire Hathaway it is! 😆

No, just kidding, do your own research and choose wisely!

Sincerely,

Pele23

Warren Buffett is arguably the epitome on the power of compounding in investing, makes we wish that I started investing way earlier in my teens. Money multiplys exponentially with compound interest :)

It would be much more if saving HBD with the interest rate, %20 ;)

AWESOME. yes, GO BERK! Buffett is the man!

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @pele23, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Around 30% on LasseCash pool.

Around 150% in 280 days mining Titan X.

Try to make your graphs from that instead?.. haha

Posted using LasseCash

That's your best @lasseehlers? Your highly centralized vanity Hive-Engine get rich quick scheme and Titan X which is based on the Richard Heart crypto scam you've been promoting for years.

You'd think that after @lasseehlers tried to scam the Hive DHF proposal system out of more than 60,000 HBD but couldn't even get one single vote of support he'd have learned his lesson that users on Hive aren't as interested in get rich quick scams as he is.