Optimism price failing to breach key barrier still proves to be profitable for 38k OP holders

Optimism price failing to breach key barrier still proves to be profitable for 38k OP holders

CRYPTOS | 07/20/2023 02:36:12 GMT

Optimism price noted a nearly 10% increase over the past day, attempting to breach the 200-day Exponential Moving Average (EMA).

Despite being unsuccessful, the price marked a two-month high, translating to profits for the addresses that bought their tokens in the past 30 days.

Unless OP declines going forward, about 120 million OP purchased by 38k addresses is enjoying 43% profits.

Optimism price has been performing better than most of the altcoins in the market for the past two weeks of the month. Even though the impact has not been significant enough to yield excessive gains for investors, a particular cohort is enjoying much more profits than they could have anticipated.

Optimism price tests multi-month resistance

Optimism price trading at $1.567 at the time of writing has risen by almost 10% in the last 24 hours. The altcoin even tested the 200-day Exponential Moving Average (EMA) during the intra-day high marked at $1.661. However, OP bulls failed to breach it for the second time in a week.

OP/USD 1-day chart

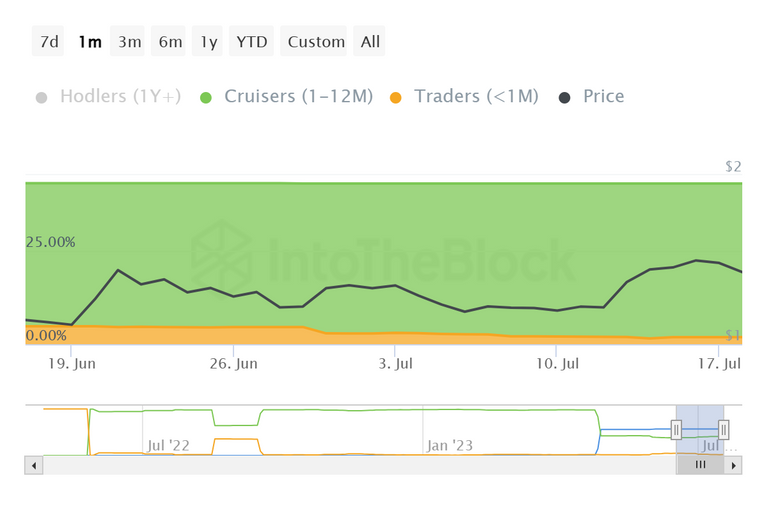

Regardless, it did not disappoint investors or at least a portion of them who purchased their supply in the last 30 days. These addresses, known as Cruisers or mid-term holders, have been holding onto their OP tokens for the past month, and it's safe to say that they have made their fair share of profits.

About 38k addresses bought more than 120 million OP tokens worth $187 million since June 20, which has grown to become profitable. Since June 20, Optimism price has increased by more than 43%, translating to similar gains for the investors that bought their supply back then.

Optimism mid-term holders supply

However, it is important to note that these gains are not concrete as the altcoin is unable to flip the 200-day EMA into a support floor. Additionally, the Relative Strength Index (RSI) is also inching closer to the overbought zone above the 70.0 mark. This zone is synonymous with corrections, and once OP breaches into the same, it could begin declining.

Thus investors looking to jump onto the profit wagon out of FOMO are better off holding off until the green candlesticks sustain, and Optimism price finds some solid support.

!MEME

Credit: unuma

Earn Crypto for your Memes @ HiveMe.me!

Source of potential text plagiarism

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

Guide: Why and How People Abuse and Plagiarise

If you believe this comment is in error, please contact us in #appeals in Discord.