10 Smart Crypto Practices

Some people look at the crypto market as a place to make easy money. They see videos of people bragging about making thousands of dollars in just a matter of hours, and they think it will be easy. They don't know that these people have probably lost everything they own on more than one occasion. The market is very volatile, so when you invest your money, it's possible you could lose all of it. If you can afford to lose that money without jeopardizing your life or home, go ahead and take the risk. But if you can't afford to lose what you will invest, don't do it!

The Smart Crypto choices are listed below:

- The crypto market is volatile, and it's essential to understand how it works before investing your cash

- Take your time and research because some coins are better than others.

- If you decide to trade, take it slow and try not to focus too much on short-term gains.

- If you're going to invest, look for coins used in the real world.

- Choose cryptocurrencies that have real value and solve real problems.

- Set up a budget so that you don't spend all of your savings on crypto

- It's essential to look at the fundamentals of what each coin is doing to improve itself and its overall value over time.

- Check out a coin's team and team leaders before buying in. See what other projects they've worked on and whether they have track records of success.

- Make sure you know the risks involved with investing in cryptocurrency before you buy in.

- Protect yourself when investing by doing your research

The crypto market is volatile, and it's essential to understand how it works before investing your cash.

Before you invest in any cryptocurrency, it's essential to understand the market and its functions. The crypto market is volatile and is known to rise or fall more quickly than other markets. It is wise to note that you should never invest more heavily than what you can afford to lose.

With all said, keep in mind the following action plan if you do want to make intelligent crypto choices:

Do your research. Educate yourself on the fundamentals of the coin before making an investment decision. Does it have real-world applications? Does a strong team back it? How does the chart look? How does this coin work? You should only be investing after you've answered these questions for yourself. The long-term success of most coins is not correlated with their hype (or lack thereof) at their ICOs; instead, post-ICO success is correlated with the team and vision behind each project.

Understand what you're buying and who is selling it. Before making any investment decisions based on what someone else says about a coin (including me), do your own research about its fundamentals and its team. Be especially aware of your personal biases towards different coins—this can affect your ability to analyze investment opportunities objectively.

Take your time and research because some coins are better than others.

You should take your time and do thorough research because some coins are better than others. As with any investment, there is no guarantee of a return on investment. However, some companies are better equipped to succeed than others. For example:

- Do they have authentic products or services, and is the company actively improving them?

- Does the company have strong leadership and a solid team?

- Is the company working with other companies in their industry or attempting to solve problems that affect their industry?

- Does the company have a strong community?

If you decide to trade, take it slow and try not to focus too much on short-term gains.

When it comes to trading, go slow. And by that, I mean, don't try to get rich quick. Don't put more money into crypto than you can afford to lose because you may lose it all. Remember: crypto markets are volatile and largely unregulated because they're still so new. Never invest more than you can afford to lose (a good rule of thumb for any investment or purchase). You'll need a strong stomach if you decide to day trade and sell based on short-term price fluctuations—you may do well, but there's also the chance of sudden losses. If you're not comfortable with this risk, consider buying and holding for the long term instead.

Suppose a particular asset catches your eye at some point in your research journey; great! Go ahead and put some money behind it—but not too much at first. It's safer to learn through small experiments rather than making huge moves right away (what casinos refer to as "playing small ball"). Once you understand how trading works and feel comfortable with it, then start putting your money where your mouth is (so to speak). During these early stages of involvement with crypto assets/currencies/whatever you want to call them, remember that there are risks involved regardless of what happens in the market. Risk is inherent in any investment! So make sure that whatever happens with your investments doesn't affect your life too much (be prepared for losses and don't assume the worst will happen).

If you're going to invest, look for coins used in the real world.

The first question you should ask yourself: what's the use case for this coin?

In other words, how is this coin being used in the real world? Does it solve a problem that people have right now and will continue to have in the future? For example, Ethereum is a platform that allows users to create smart contracts. Smart contracts are self-executing agreements from one party to another. They have a number of benefits over traditional paper-based contracts. These include reduced time, lower transaction fees, and less chance of fraud or human error.

Let's take an example. You decide to rent out your apartment on Airbnb for three weeks while you're away on vacation. The guest who books your apartment needs to pay a security deposit for his stay. Usually, he would send you a cashier's check through the mail, which takes several days to reach you and might get lost along the way. Or he might wire money directly into your bank account and hope that you send him back his deposit after he leaves your apartment in good condition (you could easily run off with the money). Neither option is ideal because they take time and leave room for error or fraud by either party. But suppose both parties agree to use a smart contract like Ethereum instead of paper-based contracts. In that case, all they need is internet access and digital wallets with cryptocurrency like Ether (ETH) in them—and they can agree with each other as quickly as they can type! In fact, numerous companies besides Airbnb, like Uber and FedEx have put smart contracts into use—and there are many more possibilities for their uses in our growing digital world!

Choose cryptocurrencies that have real value and solve real problems.

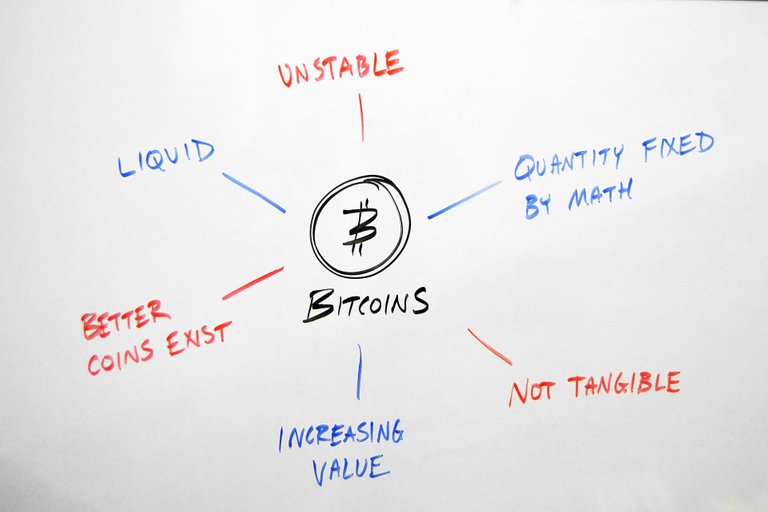

Among the thousands of coins out there, you should focus on finding cryptocurrencies that have real value and solve real problems. Many coins have no actual-world use or are used by a few people. Some companies will create a coin to raise money for their project and disappear with your money. Others are used only by criminals to launder money. These coins may seem like good ideas at first, but they don't work very well in practice because they're not fulfilling a real need.

Set up a budget so that you don't spend all of your savings on crypto

It would help if you had a plan for crypto before jumping in on trading. Many traders make a common mistake in not setting up a budget and automatic purchases. It is crucial to set up a budget so you don't gamble with too much money when you're just starting. It's also wise to automatically set up automatic purchases, allowing you to invest your money. It's all about making sure you have a plan for crypto investing before getting started

On the temptation to buy, let's say you've decided to move $10,000 into Bitcoin. Maybe you've heard about all the dramatic price swings and are banking on a few of those. You might think that if you see a slight dip in price one day, it would be wise to buy in then and make up for missing out on the last big rally. To be clear: this is not how smart crypto investment works. Crypto can be addictive, just like any other investment you're constantly checking; get started with any cryptocurrency by buying and holding—hold until your conviction changes drastically (for example: if an exchange gets hacked and loses your money). But still, even after deciding to hold, it's common for people who are new to crypto investing to start checking prices every hour. Read up on these psychological tricks so that you're aware of them when they're at work!

Only buy what you can afford.

Set up a budget. Before you dive in, make sure you have a good handle on your finances. How much money can you realistically afford to spend on cryptocurrencies? It might be better to start small and set aside more for purchases as your earnings grow.

Have a plan for what happens afterward. Do you want to use cryptocurrency for purchases? To trade? To invest? Knowing how you're going to interact with your coins will help guide your choices of which ones to buy and which exchanges or protocols are suitable for your needs.

Consider if automatic purchasing is right for you. Suppose you're interested in making regular purchases. In that case, it might be worth setting up an automatic purchase schedule to steadily accrue coins without having to remember when or if you purchased them.

It's essential to look at the fundamentals of what each coin is doing to improve itself and its overall value over time.

To make smart choices, you need to look at the fundamentals of what each coin is doing to improve itself as well as its overall value over time. Do we start with what is a product or service? With an old-school company like Coca-Cola, it's evident that they sell soda and other beverages. It's not clear in crypto since most of these companies don't have a tangible product. However, some do—and it may be a good idea to invest in them first! In basic terms, does the project provide value or solve a problem? Maybe it streamlines payments for businesses or makes it easier for musicians to get paid for their work directly from fans. Or maybe it enables real estate professionals to enter purchases into smart contracts quickly, so transactions are more secure and less likely to be fraudulent. Perhaps it improves the user interface on wallets so that people can easily see their balances and transaction histories. You get the idea — has this project come up with something that helps us live better lives?

Next up: The team behind the project matters too! Like buying stock in companies on traditional stock exchanges like NASDAQ or NYSE, you want to make sure there are qualified people running things while also having a clear vision for where they want things to go in the future (a roadmap). A strong team will also foster community among users and developers alike so that everyone stays engaged with one another over time — because no matter how great your initial idea is, without the support and regular innovation, you could quickly fall behind in this fast-paced industry!

Check out a coin's team and team leaders before buying in. See what other projects they've worked on and whether they have track records of success.

You've spent weeks researching the project and have been diligent in your due diligence with regard to the white paper. You've checked out their GitHub and even read through some of the code yourself. You're convinced this is a solid project. But before you invest, there is one more important thing to look into: the team and team leaders behind the project.

The coin's team can make or break an otherwise excellent idea - a great idea made flounder by poor execution is still just as dead as a bad idea that was never going to work in the first place. The only difference between these two scenarios is how much money you lose when everything goes south (and trust us, it will go south). A good team should always be led by experienced veterans who know their way around a computer and have had success with other projects in the past. The best teams are often a mix of people from marketing backgrounds and software engineers (plenty of whom might actually be autonomous robots) who complement each other's weaknesses and bring out each other's strengths. These are exactly the kind of people you want leading your investment - they're not going to let anything fall through the cracks!

Pro Tip: Want to check out someone's previous experience? Just search for their name on Google, LinkedIn, or Facebook! And while you're at it, don't forget to share this post with all your friends on social media so they can get in on these hot tips too!

Make sure you know the risks involved with investing in cryptocurrency before you buy-in.

You can easily lose your money if things don't go your way, so be prepared for the worst-case scenario and don't invest more than you can afford to lose. Every day, more people become interested in cryptocurrencies. Many of those people are looking to invest in the cryptocurrency market and make a profit. However, there are also scammers out there trying to take advantage of people's interests and ignorance.

While cryptocurrency can certainly be profitable, it is important to understand that investing in cryptocurrency is not without risk. The bad news is that lots of people have lost money investing in crypto assets like bitcoin or other altcoins because they lack the knowledge necessary to make good decisions. They think they understand cryptocurrency or trust someone who tells them what they want to hear and end up losing a lot of money. Unfortunately, many scammers target the world of crypto assets because it's such an easy way to dupe unsuspecting new investors into donating their money with very little chance of getting caught.

Here are some best practices for new investors:

- Before you buy any coin or token, do some research on its team members and leaders and check if there were any previous scams associated with them

- Make sure the coin solves a real problem

- Make sure the value of your investment has real value behind it (not just hype)

Protect yourself when investing by doing your research

Before you invest in cryptocurrency, it's wise to do your research. This is especially true if you're planning to get involved with a new crypto project. Make sure that the coin has a strong team behind it and that they have the experience and expertise to move their project forward. It's also important to ensure that the coin's fundamentals are sound. Many coins have lost value simply because their underlying technology wasn't very strong or didn't work as expected.

It is key to know what you're getting yourself into when you invest in cryptocurrency. There are many risks involved with this kind of investment, including volatility, fraud, hacking, and more. Make sure that you are conditioned to take these risks before you invest your money in a new crypto project

Posted Using LeoFinance Beta

Its all flowers and roses, but fact is that most of the cryptocurrencies are BULLSHIT, I go so far to say that everything is BULLSHIT except these:

#LASSECASH #HEDRON #HEX #PULSE #PULSEX #LIQUIDLOANS #BABYJESUS #ANGELOCASH

Want to debate it?

Posted using LasseCash

https://twitter.com/abiodunadeosu19/status/1521262942796369921

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.