Are We Out Of The Bears Yet As Glassnode Takes A Critical Look At The On Chain Signals

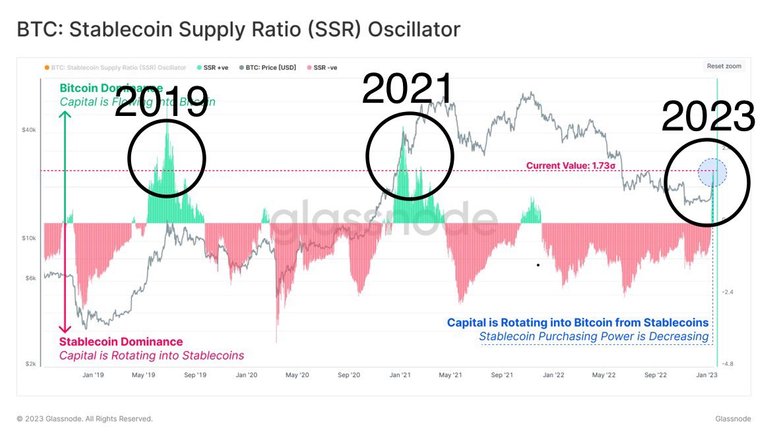

The financial institution glassnode is taking a critical look at the on chain signals which suggest that bitcoin is out of the bearish market, in a report which they talk about three of these indicators that suggest so one of these indicators is the stable coin supply ratio, the SSR is said to track the rotation of capital by investors between stable coins and bitcoin.

It’s been observed that investors are taking advantage of the bitcoin bear movement to make purchases of the digital asset using stable coins. In a brief note which was given they said that;

Currently, we note a significant transfer of capital to the Bitcoin asset, akin to the twilight of the 2018 bear market and the 2021 rounded top.

The second indicator which was talked about was the RPV profits to value ratio, which they made comparison with the lows of precedent years as regards profit taking in the market. They say presently it has reached a point of recovery, in their words it’s stated that;

The RPV ratio collapsed to prior cycle lows, suggesting much of the exuberance from the bull has been flushed out.

And lastly in the FTX collapse which they say that the amount of bitcoin held in a loss which indicates that the supply in loss metric has been reached. Since then the market lows set during the FTX collapse, a total of 4.283 million BTC have returned to an unrealized profit.

This provides an indication of the volume of Bitcoin that has transacted, and changed hands between $15,500 and $22,300.

If you see this post on a Web2 ecosystem and you have no clue about what Leofinance is here is a brief definition;

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Over here we refer to users as lions, so are you ready to be a lion here is my referral link

Also don’t forget in contributing to the pHBD-USDC pool, and from statistics it looks like we will be able to archive the set target in a few months, let’s do our own part in growing the pHBD-USDC liquidity and also take out time to participate in the Leo power up challenge which happens every 15th of each month.

Let’s also connect on some of the web2 platform.

Twitter:Hironakamura

Posted Using LeoFinance Beta

https://twitter.com/1471589002054492160/status/1618092395052306434

The rewards earned on this comment will go directly to the people( @hironakamura ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.