What You Didn't Know About Cherryswap

We've had a couple of DeFi protocols rolling in this year, and most of them have been a success in terms of offering what it was designed to. Ranging from uniswap being the leading protocol built on the Ethereum blockchain, our very own Cub finance, down to the famous and recently utilized protocol "pancakeswap" on Binance Smart Chain, with all these great projects, we can't deny the fact that "Defi" is way bigger than what it currently is, and there's very much more to come.

That said, Cherryswap is one fresh protocol that caught my attention, it's built on Okex chain and it isn't so bad if you ask me.

Okex has recently become my most trusted chain and exchange. Even though it doesn't quite have those varieties like Binance and Kucoin which happen to be the king of varieties, it's still a very user friendly exchange, user verification required, yes, but it's way better than others I've tested.

I was scrolling through Okex stake and earn section when I stumbled on Cherryswap and I decided to dig in a lil bit.

CherrySwap is the automatic market-making protocol based on OKExChain(OEC).

It adopts the mechanism of Automatic Market Maker (AMM) and aims to achieve self-driven liquidity creation with diversified functions such as liquidity mining, IFO, NFT, lottery, and DAO, so as to provide participants with the maximum value bonus.

The swap has had to deal with an IFO rug pull, which wasn't their fault. The team took it on themselves to compensate those that were affected by it, I believe this is still ongoing

However, regardless of that, cherryswap doesn't quite have that internet presence score, quite a few know of it, yet the swap volumes are insane. Whales? Self manipulated? Or just a low key gem? When lambo? Or when rug pull?

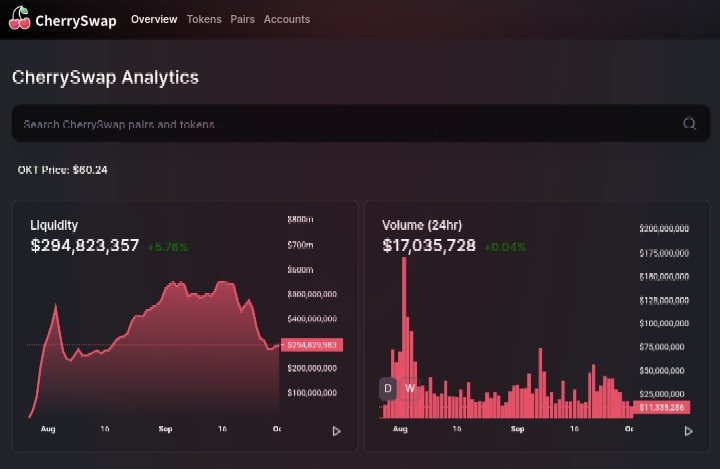

Comparing it to any other swap protocol wouldn't be so fair at the moment, however, there's currently some crazy staking APR up for grabs and it's token happens to be very limited in supply. The current price is $1.2 per unit, and the protocol has over $290k in liquidity and more than $17 million 24hrs volume. Though I'm not directly farming on their site, like I had mentioned in my most recent post, I'm currently just staking on Okex for the experiment, a flexible 320% APR. So if diversifying is ya thang, here's a link to their road map. If this turns out to be great, then we may be seeing a competitor to other Defi protocols.

What you didn't know about cherryswap you ask?

Well, it's new, sexy, and risky, wink ;)

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

New - check. Risky - check. Sexy - check. Sold.

Posted Using LeoFinance Beta