As a new trader don’t hold Leveraged tokens, this is why

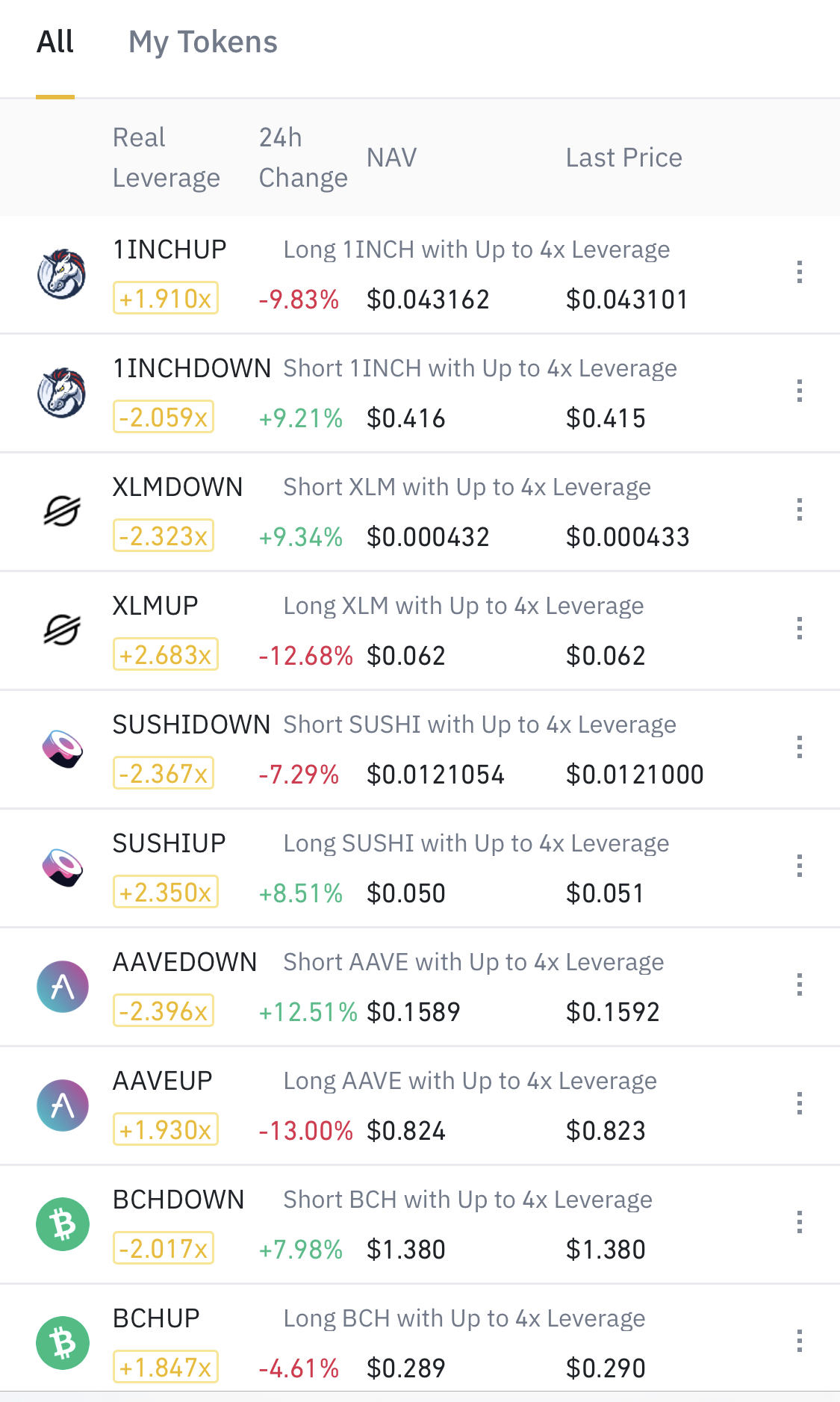

Leveraged tokens are tokens ( derivative product) that allows leveraged exposure to the underlying assets. For instance, you must have seen ETHBULL or ETHUP token, a 3x long ETH. This means that for every 1% of ETH that goes up, ETHBULL goes up by 3%. Same goes with the opposite. For every 1% of ETH that goes down, 3% of ETHBULL goes down as well. Exchanges like Binance and FTX offer this.

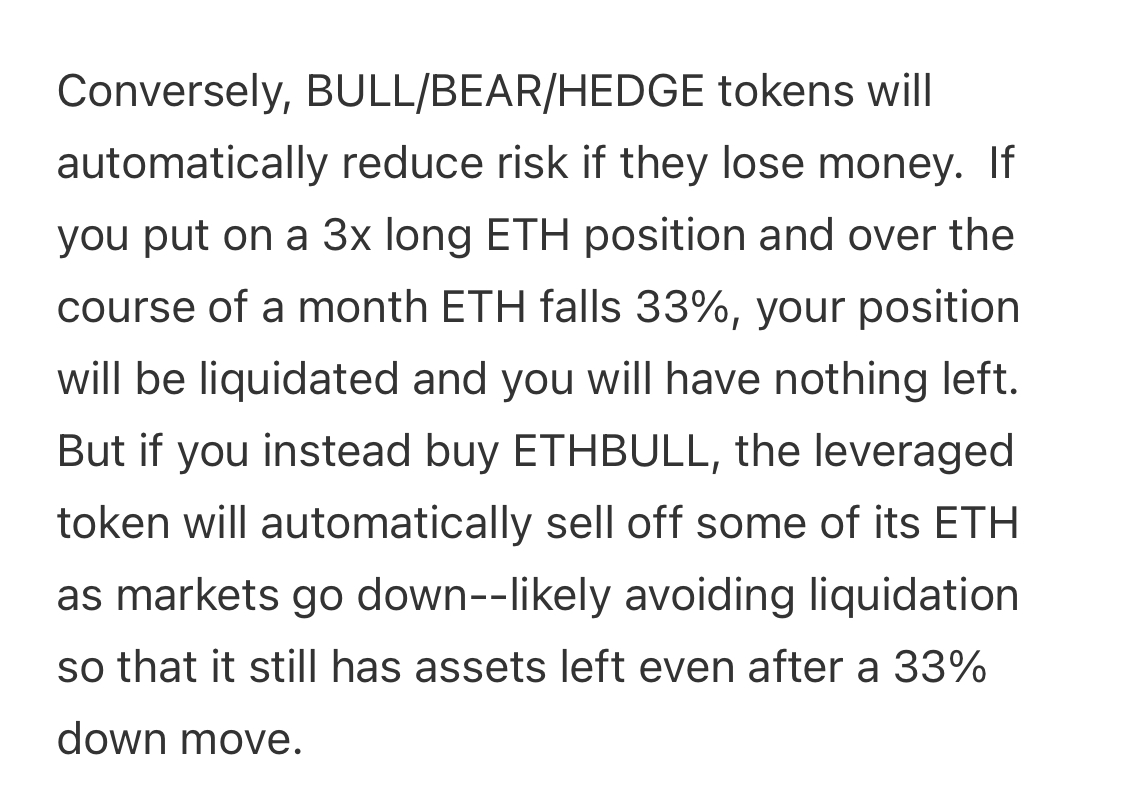

Leveraged tokens work this way, let’s say you buy ETHUP/ETHBULL, the moment the price of etherium starts going up, you start making profit. Then when you buy ETHDOWN/ETHBEAR, you start making profit when the price of ETH goes down. But the mistake most new traders do is holding these tokens for an extended period of time. This is because leveraged tokens are extremely dangerous because they inherit volatility decay that would result in severe loss in the long run. This volatility decay is the compound loss that occur over time because of the daily rebalancing of the leveraged token during volatility. This means the higher the volatility of the market, the more exchanges have to de-lever(deleverage), the higher the loss.

Posted Using LeoFinance Beta